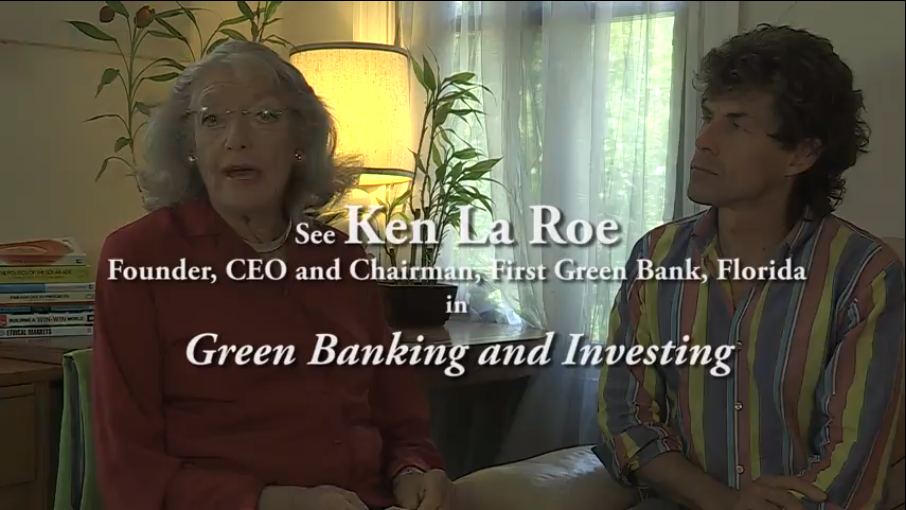

398 – Promo – “Green Banking and Investing”

Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 2013

Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 2013

“Nurturing Sustainable Local Communities Worldwide” – Interview with Steven Lovink – Founder/CEO, Planet2025 Network and Power of One; Ethical Markets Transforming Finance Series 2013

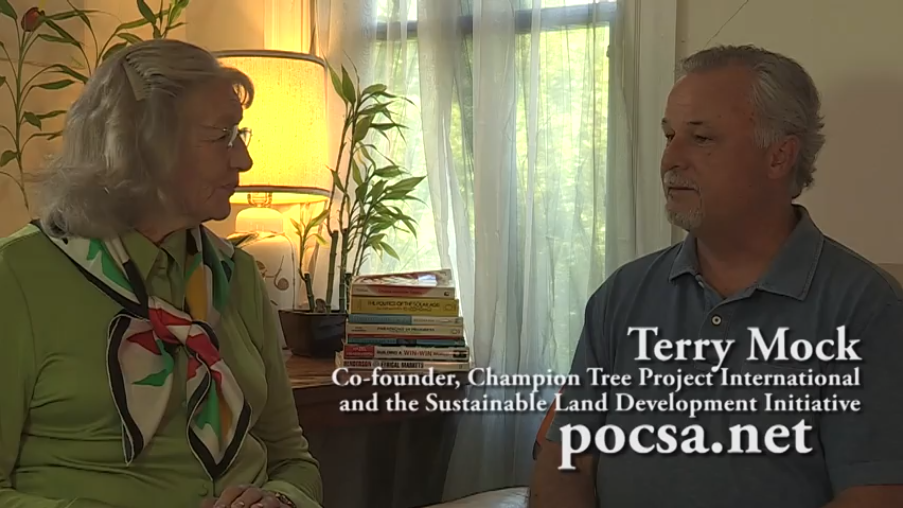

“Permaculture, Eco-forests Developing Green Economies”

Terry Mock – Co-founder, Champion Tree Project International and the Sustainable Land Development Initiative; Ethical Markets Transforming Finance Series 2013

“Financing the Green Transition to the Coming Solar Age”

Peter Lynch – Private Investor and Financial/Technology Advisor to Investors; former senior editor, Photovoltaic Insider Report; Ethical Markets Transforming Finance Series 2013

“Healthy Foods, Healthy Lifestyles: Paths to Happiness”

Martin Ping – Executive Director, Hawthorne Valley Association, Ethical Markets Transforming Finance Series 2013

“Strengthening Locally Owned Independent Finance”

David Rose – Founder and CEO, Unified Field Corporation; Creator, Unified Field Bank™, Ethical Markets Transforming Finance Series 2013

“Fostering Homegrown Reliable Economies”

Stuart Valentine – Principal, Centerpoint Investment Strategies, Ethical Markets Transforming Finance Series 2013

Financing Clean Development – interview with Graciela Chichilnisky, “Transforming Finance” — an Ethical Markets Media production © 2010

Private Financing of Green Companies – interview with Karl Kleissner, “Transforming Finance” — an Ethical Markets Media production © 2010

“Daring to Care: Growing the Love Economy” – Interview with Louis Böhtlingk – Founder, Care First World; author, Dare to Care; Ethical Markets Transforming Finance Series 2013

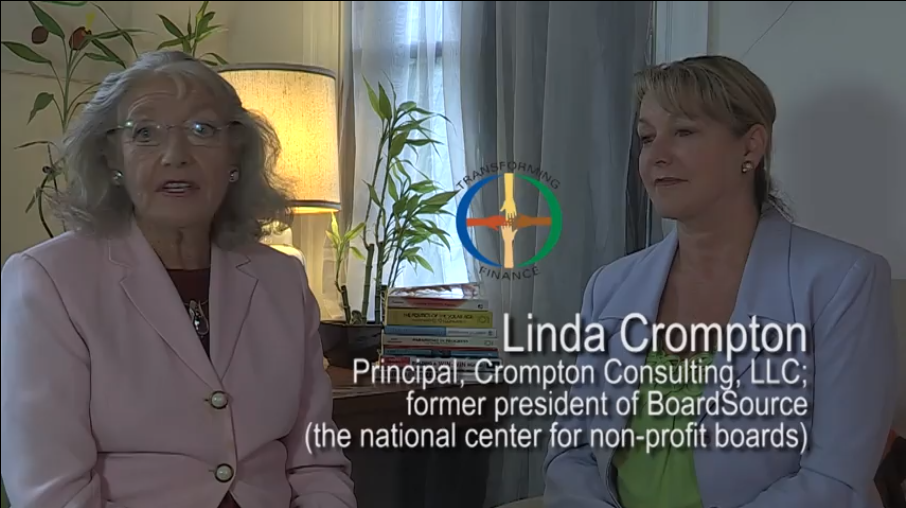

“Recognizing the Power and Purpose of Non-profits” – Interview with Linda Crompton – Principal, Crompton Consulting, LLC; former president of BoardSource (the national center for non-profit boards); Ethical Markets Transforming Finance Series 2013

Greening of Pension Funds interview with Bryan Martel, “Transforming Finance” — an Ethical Markets Media production © 2010

Steering Capital Toward Sustainability interview with John Fullerton, “Transforming Finance” — an Ethical Markets Media production © 2010

Finance is a Global Commons interview with Leo Burke, “Transforming Finance” — an Ethical Markets Media production © 2010

Escaping the Web of Debt – interview with Ellen Brown, “Transforming Finance” — an Ethical Markets Media production © 2010

Martin Ping – Executive Director, Hawthorne Valley Association, Ethical Markets Transforming Finance Series 2013

Finance Should Serve Society – interview with Steve Waddell, “Transforming Finance” — an Ethical Markets Media production © 2010

“Financing the Green Transition to the Coming Solar Age”

Peter Lynch – Private Investor and Financial/Technology Advisor to Investors; former senior editor, Photovoltaic Insider Report; Ethical Markets Transforming Finance Series 2013

China’s New Development – interview with Zhouying Jin, “Transforming Finance” — an Ethical Markets Media production © 2010

“Nurturing Sustainable Local Communities Worldwide” – Interview with Steven Lovink – Founder/CEO, Planet2025 Network and Power of One; Ethical Markets Transforming Finance Series 2013

“Fostering Homegrown Reliable Economies”

Stuart Valentine – Principal, Centerpoint Investment Strategies, Ethical Markets Transforming Finance Series 2013

“Permaculture, Eco-forests Developing Green Economies”

Terry Mock – Co-founder, Champion Tree Project International and the Sustainable Land Development Initiative; Ethical Markets Transforming Finance Series 2013

“Green Banking and Investing” – Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 2013

“Green Banking and Investing” – Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 201

“Beyond Economics to Earth Systems Science” – Interview with Michael Grunwald – TIME, Time.com, Senior National Correspondent; author, The New New Deal (2012); Ethical Markets Transforming Finance Series 2013

“Transition to the Green Economy” – Interview with Michael Grunwald – TIME, Time.com, Senior National Correspondent; author, The New New Deal (2012); Ethical Markets Transforming Finance Series 2013

“Investing in Desert Greening” — Discussion with Dennis Bushnell, chief

scientist, NASA Langley; Carl Hodges, founder, Seawater Foundation, and

Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

“Making Ethical Investing the New Norm” — Discussion with MARIANA BOZESAN, Founder & General Manager of AQAL Capital GmbH, and GARVIN JABUSCH, cofounder and chief investment officer of Green Alpha ® Advisors, and Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

“Rating the Rating Agencies” — Discussion with Claudine Schneider, Congresswoman, US House of Representatives (R-RI), 1980-1990,Lawrence Bloom, FRICS, Co-Founder & Chairman, B.e Energy, and Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

“How Adam Smith and Charles Darwin Got Hijacked” – Discussion with Kim Ann

Curtin, author, CEO, The Wall Street Coach, and Hazel Henderson, president,

Ethical Markets Media; Ethical Markets Transforming Finance Series 2014

“Transforming Wall Street” – Discussion with Kim Ann Curtin, author, CEO,

The Wall Street Coach, and Hazel Henderson, president, Ethical Markets

Media; Ethical Markets Transforming Finance Series 2014

In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, what reforms still are needed in capital markets. They review the challenges and progress over the past decades as ethical, green investing began to go mainstream which now in the USA alone comprises $6.57 trillion or 18% of total investments. Future expansion is expected as accounting reforms expose real risks such as water shortages and climate change excluded in traditional financial models

In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, what reforms still are needed in capital markets. They review the challenges and progress over the past decades as ethical, green investing began to go mainstream which now in the USA alone comprises $6.57 trillion or 18% of total investments. Future expansion is expected as accounting reforms expose real risks such as water shortages and climate change excluded in traditional financial models.

In this program, Hazel Henderson discusses with Dr. William Abare, President, Flagler College, how education is changing. They explore the growing challenges to education: costs rising faster than inflation; students bearing $1.2 trillion in loans while facing disruptive technological changes and job markets shifting globally. Traditional colleges are challenged by massive open online courses (MOOCs) such as Khan Academy, backed by Bill Gates, and other start-ups now funded by Silicon Valley capitalists, with millions of students learning free online. How can the benefits of campus-based education be extended to include more student and help counter growing inequality?

In this program, Hazel Henderson explores innovative courses with Dr. Allison Roberts, Chair of the Business Administration Department, Flagler College. They critique the values underlying much traditional business education which still teach with obsolete textbooks and assumptions that self-interest competition is “human nature”. Old courses still assume the impacts of business activities harming others and their environmental costs can be “externalized” from company balance sheets. Dr. Roberts, whose doctorate is in health and labor economics, has designed a more scientific curriculum, taking account of social and technological changes that have changed the global economy. Dr. Roberts teaches broader analyses and strategies for business success and new scorecards so that her students can prosper in the 21st century while contributing to more sustainable societies

– In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, how business courses need to catch up with changes in today’s finance and business. They review the urgent need to reform curricula at business schools in North America and Europe. Many still are teaching from obsolete textbooks with faulty assumptions that still permit companies, financiers and governments to “externalize” the social and environmental impacts from their balance sheets and pass on the costs to taxpayers, citizens and the environment.

In this program, Hazel Henderson and Asian Markets Sustainability Analyst Matthew McGarvey, both China experts, review the new challenges China poses to Western economies as well as from other emerging economies in Asia. Western economists misunderstand the restructuring in China from exports toward domestic goals and shifting from polluting coal to wind, solar and the “circular economy” and their “Green GDP.” The new Asian Infrastructure Investment Bank (AIIG) led by China has attracted members like Britain and other European countries, as well as the IMF. Yet, the US Congress refused to join and is now out in the cold. The rush to new mega-trade deals in Asia and the need for new rules and metrics are explored.

In this program, Hazel Henderson and Asian Markets Sustainability Analyst Matthew McGarvey, who has lived in China, Vietnam and regularly visits Asia, discuss trends toward new values beyond Western GDP-measured economic growth. Asian economics’ models tend toward the Chinese view that “markets are good servants but bad masters.” Government rule-setting and oversight are favored and often authoritarian. Matt McGarvey recounts his personal journey from growing up in America’s heartland to learning Chinese and working in Beijing, and his experiences in Vietnam and other Asian countries.

In this program, Hazel Henderson and NASA Chief Scientist Dennis Bushnell discuss the new alarms raised by Bill Gates, Google’s Eric Schmidt, Space-Ex and Tesla’s founder Elon Musk and physicist Stephen Hawking that intelligent machines like IBM’s Watson may soon outsmart humans. These computer pioneers believe this could pose existential danger to human civilization – because they may not share human values and may cause us great harm. Bushnell cites all the areas where computers are already smarter and more efficient than humans: in law, medicine, accounting and will be needed in NASA’s space program. Henderson worries about the societal impacts as ever more sectors of modern economies are digitized, now displacing white collar jobs beyond earlier manufacturing automation since the 1960s. While futurists envisioned “leisure societies,” shorter work weeks, guaranteed basic incomes and flowering of culture, art and human potentials – what we got was unemployment, stagnant wages and longer work hours.

In this program, Hazel Henderson and NASA Chief Scientist Dennis Bushnell explore the advance of automation as ever more sectors of industrial societies are digitized: from manufacturing to retailing, accounting, healthcare, education, legal services and even finance. Driverless vehicles will end jobs in trucking, taxis, which offer millions of entry-level opportunities. Fly-by-wire airplanes have caused the deskilling of pilots, some of whom have been confused when computerized navigation systems have failed – causing crashes. Can computerized systems be programmed with human values: empathy, compassion and ethics? Can a driverless car pass an ethical test of judgment: swerving to avoid hitting a group of people at the expense of colliding with a single person? Bushnell points out how much more efficient computers are at many tasks than humans. Henderson looks at the macro-effects: how can economies maintain aggregate demand to buy all the new productivity’s goods and services? How can people obtain purchasing power if not from jobs? They discuss alternatives emerging: worker-owned companies, cooperative enterprises and guaranteed basic incomes now enacted in Brazil, Mexico and proposed in Switzerland, Europe and the USA.

– In this program, Hazel Henderson explores with law professor Jon L. Mills, former speaker in Florida’s House of Representatives, his current book, Privacy in the New Media Age. The Internet, social media, blogs, “citizen-journalists” and global news distribution pose thorny issues in all countries. While the USA favors free speech over individual rights to privacy, European countries are protecting people’s “right to be left alone” and the deletion of old records of individual behavior which may jeopardize their future employment. While Facebook and Twitter facilitated the grassroots protests and rebellions of the “Arab Spring,” these social media also helped police to track down the dissidents and their prosecution. Prof. Mills points out that technological innovations always outrun the pace of law and public responses. Different rules apply in many countries and global agreements may take decades.

– In this program, Hazel Henderson continues discussing with Professor Jon L. Mills his current book, Privacy in the New Media Age. The conversation focuses on the USA and how the Constitution favors free speech and press in the First Amendment over individual rights to privacy. Mills cites many examples of how individuals are harmed in today’s social media, by false statements by bloggers, ubiquitous cameras in public places, tracking individuals’ movements via their cellphones and GPS. They explore data-collecting by government and by corporations selling users’ personal data to advertisers, as well as snooping by drones. Again, these new technologies and media have outrun the law and public awareness and in some cases even dubious rulings by the Supreme Court.

In this program Hazel Henderson discusses with John Englander, geologist and oceans expert, author of Rising Tide on Main Street, the steady rise of global oceans due to global atmospheric levels of carbon dioxide and other greenhouse gases. The Earth’s temperature continues rising as fossil fuels are burned, oceans absorb additional CO2, glaciers and ice sheets at the planet’s poles are melting. Englander studies coastlines and show visual evidence of the effects on the World’s 20 most vulnerable cities: Boston, New York, Washington DC, Seattle, San Diego, as well as Shanghai, London, Bangkok and low-lying countries Holland, the Philippines and many small island sates. In some areas, land is also sinking, and in others tectonic plates cause the land under, for example Los Angeles, to rise. Since 2015, 195 countries have agreed to address these largely human-caused effects with transition management strategies: investments in adaptation, sea walls, more and higher levees, relocation of humans settlements and shifting to renewable energy. Timeframes for action are reviewed. Transition management begins with realistic views of global change. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson discusses with John Englander, geologist and oceans expert, author of Rising Tide on Main Street, all the sensible, realistic ways that humans can practice transition management: by mitigating and adapting to rising sea levels. The world’s oceans will continue their steady rise – even if fossil fuel burning were to cease immediately. The long-term processes set in motion by rising global temperatures, melting glaciers and polar ice sheets are altering risk-analyses models in finance, insurance and business. Transition management strategies and options are discussed, from changing real estate values; building codes; reinforcing urban infrastructure; siting of essential transport and communications networks, as well as how investments will be affected and where new opportunities lie in shifting beyond fossil fuels to low-carbon, cleaner green economies. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson discusses transition management strategies and the likely next stage of capitalism with Terry Mollner, author of Common Good Capitalism: It’s Next! and board member of Ben and Jerry’s ice cream, now owned by global food giant Unilever. Terry describes the saga of this negotiation with Ben and Jerry’s shareholders, their effort to remain independent and how their social mission was recognized and began to change Unilever. Terry points to the current wave of mega-mergers in our global economy, where brands in food, air travel, communications and many other sectors end up cooperating as duopolies. In this world beyond competition companies can reach a new level: changing their goals and business models so as to place top priority on cooperatively serving the common good with competitive profit-seeking taking second place. How to square this with anti-trust conventions will be key. These startling views will be hotly debated as human populations and economies learn transition management strategies as tools to develop further on our small finite planet. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson with Terry Mollner, author of Common Good Capitalism: It’s Next! examine his hopeful view of transition management. Mollner explains how capitalism can evolve from today’s global completion for resources and markets and the toll this takes on our societies and planetary ecosystems. Competition and human creativity have brought us to this stage. Both agree on today’s wider perception, scientific discoveries, new communications tools, satellites observing our effects on the Earth which make it evident that cooperation must now be the framework for all our actions. This is in line with Charles Darwin’s view that humanity’s success in evolving for millennia is based on our genius for cooperating. Nature’s transition management is driven by adaptation to environmental stresses. Darwin’s conviction saw our further development would lead to more altruism as we recognize our inter-dependence on each other and all lifeforms on our planetary home. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson discusses a range of global challenges and transition management strategies with Frank Dixon (Harvard MBA), former head of global research with the famed, pioneering social auditing firm Innovest. They discuss the ways in which global geopolitics is evolving in response to the systemic changes to our planet’s ecosystems due to human activities. As water shortages, drought, floods and climate disruption effect more countries and populations, decision-makers in business government and civic society are seeing that all these problems are inter-linked. Frank Dixon’s book, Global System Change, maps these global issues and connects the dots. At the same time, Henderson points to the same new awareness by over 190 member countries of the United Nations in their 2015 agreement on the 17 issues addressed in their Sustainable Development Goals (SDGs). There is now evidence that humans are accepting responsibility for the changes created by unsustainable industrial development and moving toward integrated policies. These realistic approaches to transition management can lead to cleaner, healthier, more equitable societies on which our survival may depend. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson discusses with Frank Dixon, MBA, author of Global System Change, the massive transition now underway to innovate and build societies powered by renewable energy and resources. All are based on more cooperative sharing models. This transition management is driven by new paradigms beyond traditional economics which are multi-disciplinary. They are based on new understanding of human behavior and the integrated science of Earth systems with information from 120 orbiting observation satellites. They discuss how all this new knowledge is seeping into financial models and steering investments in more sustainable production and ways of organizing human settlements and regenerating ecosystems. All these new transition management methods require redefining growth and prosperity and reshaping our political systems, mass media and lifestyles. These changes ae underway at every level from individuals and communities to nations, corporations and international organizations. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson explores with Frank Dixon, MBA, author of Global System Change, the damaging effects of the global gem mining industry, now a case study in transition management. This industry has been the focus of many NGO critics since diamond mining is not only dangerous and polluting, but has helped fuel armed conflicts in many African countries. Several UN resolutions have addressed the need to stop the flow of these “blood diamonds” and the global diamond cartel has responded with the Kimberley Certification which only certifies their diamonds are “conflict-free”. This ignores the much larger problems of miners’ injuries, deaths, low wages and the pollution of water supplies and air in mining areas and communities. Beyond these hazards is the fact that this gem mining industry is now obsolete and unnecessary, since science now produces identical gems in laboratories in many countries without human and environmental damage. Thus Dixon examines Ethical Markets transition management tool: its global standard, EthicMark® GEMS which certifies only gems not mined from the Earth. Dixon asks Henderson how this better standard was developed and how it can challenge this obsolete mining industry by this market-based transition to reform: EthicMark® GEMS can create a healthier new industry and many thousands of new jobs while saving lives, human misery and the environment – an illustration of positive transition management. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson discusses with Marcello Palazzi, MBA, president of the Progressio Foundation in Holland, their experiences in developing these new standards for transition management: corporate social performance and auditing over the past 30 years. Palazzi recounts his path in business and how he came to realize that standards for environmental, social responsibility were rising as the effects of corporate activities disrupted communities and ecosystems. Henderson’s experiences came from a civic organization she co-founded, Citizens for Clean Air, in the USA and how this led to her lifelong work as a science policy advisor in Washington and with the Calvert Social Investment Fund. Both had focused on aspects of transition management, developing new accounting models and metrics. These are now globally accepted by such organizations as the International Integrated Reporting Council (IIRC), the Global Reporting Initiative (GRI) and the Sustainable Accounting Standards Board (SASB). Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson discusses with Marcello Palazzi, MBA, president of the Progressio Foundation in Holland, his latest work in transition management by promoting the new business charter: the Benefit Corporation, which certifies companies which focus beyond profitability to service and benefit society. This new model is now legally chartered in 30 states in the USA, also in Latin America and Europe. The founders of Certified B Corporations Jay Coen Gilbert, Andrew Kassoy and Bart Houlahan recently were awarded a coveted prized by the Aspen Institute. Palazzi and Henderson explore examples of B Corporations, which include Ethical Markets Media. This new socially responsible business model is enjoying rapid growth and includes several publicly traded corporations. These examples are further case studies in positive transition management. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson discusses with award-winning civic leader Thais Corral, co-author of Leadership Is Global, the current crises and transitions occurring in her country Brazil. Brazil has all the resources and capital assets it needs to make the transition to sustainability, including human, social and intellectual capital with advanced infrastructure and industries, and the planet’s primary storehouse of natural capital. However, Brazil’s active democracy needs to shake off the obsolete fossil-fueled industrial model still imposed by foreign investors and traditional financial models. Thais Corral points to Brazil’s rich civic society traditions, participatory politics, its optimistic people and their open flexibility in embracing change as their best resource in transition management. This civic genius is the “software” that may prove to be Brazil’s unique export to the world and its struggle for domestic reforms offer lessons for other countries. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson explores with award-winning civic leader, recognized in Brazil by the UN, Thais Corral, co-author of Leadership Is Global, her personal story. Thais and her family came to Brazil from Spain, bringing their entrepreneurial skills and creativity. Thais, a lifelong learner, spent years studying in Italy, other European countries, and the USA at the University of Chicago and Harvard. She innovated 400 radio programs broadcasted to empower women across Brazil and became a co-founder of the global Women’s Environment Development Organization (WEDO) with US Congresswoman Bella Abzug. Thais then founded the learning and leadership programs at Sinal do Vale, a large estate 30 minutes from Rio De Janeiro’s mains airport, where participants learn all the tools of transition management first hand. Ethical Markets is partnering with Thais in this new educational program since Thais is a member of our global Advisory Board. Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson interviews her longtime associate Alice Tepper-Marlin, president-emeritus of SAI International and key founder of the pioneering transition management example: the socially responsible investment movement. They reminisce on the evolution of this form of accounting which screened portfolios and companies for their ethical, social and environmental performance. Tepper-Marlin founded the pioneer group, the Council on Economic Priorities (CFP) in the 1960s and Henderson became a board member, along with famed economist Robert Heilbroner, author of The Worldly Philosophers (1999). Tepper-Marlin recounts the first study by CEP of pollution in 24 pulp and paper companies and how the companies stalled at first but eventually provided data. CEP’s consumer guide, Shopping for a Better World, sold over 1 million copies and catapulted CEP into creating this new branch of accounting and securities analysis – and Tepper-Marlin into widespread media recognition. Another successful model of positive transition management! Ethical Markets Transforming Finance Series, @2015

In this program, Hazel Henderson discusses with Alice Tepper-Marlin, president-emeritus of SAI International and founder of 10-Squared, the future of accounting for ethical, social and environmental performance of portfolios, companies and governments. This important tool of transition management is full-spectrum accounting, a multi-disciplinary method. This goes beyond the earlier money-based models evaluating life-cycle costs and recognizing 6 kinds of capital: financial, built facilities, intellectual, social, human and natural capital. These broader metrics are now promulgated globally by the International Integrated Reporting Council (IIRC) and the Global Reporting Initiative (GRI) and in the USA by Sustainable Accounting Standards Board (SASB), chaired by Michael Bloomberg. At last, the obsolete models in traditional economics permitting social and environmental costs to be “externalized” is exposed as irresponsible. Tepper-Marlin describes her latest venture 10-Squared, another transition management innovation and management tool for companies to achieve better social and environmental performance goals. Ethical Markets Transforming Finance Series, @2015

Hazel Henderson discusses the evolution of the ethical, responsible, green investment movement with British pioneer investor Tessa Tennant. Tennant founded the first green UK mutual fund as well as the Social Investment Forum. She reviews the early obstacles, as she founded ASRIA, the first such group in Asia. An inspiring personal story! © 2016 Ethical Markets

Responsible Investors

Hazel Henderson and UK investment pioneer Tessa Tennant look at the new consensus emerging in 2015 for the global transition from fossil fuels to clean, green, sustainable economies. Tennant serves on the British Green Investment Bank. Now that 195 countries have signed on to the United Nations Sustainable Development Goals (SDGs) and the COP21 Climate Accords, this transition is accelerating worldwide. © 2016 Ethical Markets

In this program Hazel Henderson explores with Dr. Monica Sharma, author of Radical Transformational Leadership (2018) her personal story growing up in India. How she practiced medicine there and grew to understand the importance for human health of looking at her patients’ life circumstances and their environments. Dr. Sharma became a leader in many United Nations health initiatives and her leadership style can inspire and empower many others.

“Your Money Or Your Life”

with author Vicki Robin

In this program Hazel Henderson discusses with author Vicki Robin how the financial markets have changed since her book “Your Money or Your Life”, originally co-authored with Joe Dominguez, was first published in 1993. This perennial best-seller was updated again by Vicki Robin in 2018 and found a new audience of half a million millennial followers. Vicki describes how investing has changed to focus more locally and personal growth an achievements. Vick’s new fame includes interviews in the Wall Street Journal, The New York Times and the cover of Money Magazine.

Ben Bingham, 3 Sisters Sustainable Management, LLC

Downsizing and reforming global capital markets with pioneer asset manager Benjamin Bingham on financial transactions tax to curb excessive speculation and high-frequency trading, closing tax havens, raising capital reserves, breaking up too-big-to-fail banks and more. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

“Blessing the Hands That Feed Us”

with author Vicki Robin

In this program Hazel Henderson discusses with author Vicki Robin the unsustainable global food system and reforms needed, described in her book “Blessing the Hands That Feed Us”. Vicki describes how locally-grown organic foods are a growing segment worldwide and offer better nutrition as well as more secure livelihoods for farmers. Opportunities are discussed on all the ways our unsustainable global agro-chemical industrial complex with its narrow mono-culture crops in global trade are feeding perilously on the planet’s 3% of freshwater. Meanwhile all the hundreds of salt tolerant food plants that grow in 22 countries on desert lands can be added, along with many other overlooked native plants, as well as all the startups in plant-protein foods offering better nutrition for the growing vegetarian consumer markets.

Katherine Collins, Honeybee Capital

Holding stock-markets to higher ethical standards, regulation and oversight for accountability. Why successful asset manager Katherine Collins sought a more ethically satisfying life beyond Wall Street after her degree at Harvard Divinity School. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

In this program Hazel Henderson discusses with Paul Ellis, veteran financial adviser and consultant, how his practice evolved into broader concerns for our common future. Paul had discovered the Calvert-Henderson Quality of Life Indicators (2000) which Hazel and the Calvert group developed. Later, in 2015 Paul found the United Nation’s Sustainable Development Goals (SDGs). Paul and Hazel had never meet until this show. They discuss how their mutual goals became aligned in their respective efforts to reform mainstream finance and its narrow focus on obsolete economics and short-term profits. Now both work in a new partnership to promote the SDGs!

Susan Davis, Capital Missions Company

Legendary banker Susan Davis describes her winning philosophy, KINS, based on strategies of generosity, win-win deals, connecting investors around conscious capitalism and growing fairer, greener economies worldwide as described in her autobiography, The Trojan Horse of Love. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

In this program, Hazel Henderson and Paul Ellis discuss their respective and complementary work in reforming mainstream finance and economic textbooks. They share how these obsolete models and metrics had been steering societies toward greater environmental despoliation and unanticipated social problems.

Money-based Gross Domestic Product (GDP) was never intended to be a measure of human progress, while over averaged macroeconomic indicators of inflation, unemployment, savings, etc. were like flying over a country at 50,000 feet! Both Hazel and Paul rejoiced in 2015 when 195 member countries of the United Nations launched their Sustainable Development goals (SDGs). At last, these 17 Goals, ratified by all sectors, systemically based in metrics of empirical sciences, can now steer the world’s countries away from the cliff edge toward knowledge-richer, inclusive sustainable societies for our common human future.

Amy Domini, Domini Social Investments

Industry icon Amy Domini, author of the landmark book Socially Responsible Investing, Making a Difference and Making Money. Amy created the Domini Social 400 Index which regularly outperforms conventional benchmarks and founded Domini Social Investments. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Alisa Gravitz, President, Green America

Alisa Gravitz took her Harvard MBA into uncharted waters in co-founding Green America and the National Green Pages. Her latest innovation is CREW, a business-to-business barter site. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Leland Lehrman, Fund Balance, LLC

Leland Lerhman, principal, Fund Balance, is an investor with deep ecological understanding and visionary proposals for correcting the failing financial models. These derived from obsolete economics now harming both humans and our planet. Leland and Hazel are both advisors to the Public Banking Institute founded by lawyer Ellen Brown, author of The Web of Debt. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Christopher Lindstrom, Slow Money

Christopher Lindstrom and Hazel discuss their longtime, often shared efforts to reform the money-creation process. They both promote the many local, complementary currencies now in circulation in hundreds of cities around the world. Chris was a key actor in launching “Berkshares,” the successful currency of the Schumacher Society developed by Susan Witt in Great Barrington, Massachusetts. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Terry Mollner, Trusteeship Institute, Inc.

Terry Mollner, a leader in co-founding the Calvert Group of socially responsible mutual funds also spent time in India following the exemplary life of Mahatma Gandhi. He also serves on the board of Ben and Jerry’s Ice Cream, now owned by Unilever. Terry got this giant multinational to sign a path breaking agreement to preserve Ben and Jerry’s social mission. Terry and Hazel agree that the next stage of finance is full recognition of the primacy of the global commons and hence placing the common good above all else if we are to preserve our common future. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Sarah Stranahan, New Economy Network

Longtime community-development specialist, housing expert and investor Sarah Stranahan tells Hazel how the struggling US housing market can be revived by adopting viable policies pioneered during the New Deal. Millions of homeowners were saved from foreclosure then, and the US Treasury can do the same by following these policies and revitalizing Fannie and Freddie – owned by US taxpayers already! “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Building the Woman’s World Banking Movement – interview with Michaela Walsh; Ethical Markets Transforming Finance Series 2013. Michaela Walsh is Founding President of Women’s World Bank http://www.swwb.org/, expanding economic assets, participation and power of low-income women and their households by helping them access financial services, knowledge and markets. She discusses transforming finance through women’s banking with Hazel Henderson.

Banking for the Common Good – interview with Mary Houghton, Ethical Markets Transforming Finance Series 2013. Mary Houghton is the co-founder of ShoreBank, once the largest and oldest community development bank in the US. She shares her transforming finance views on community banking with Hazel Henderson.

The Green Economy — A Wide Shot – interview with Gregory Wendt; Ethical Markets Transforming Finance Series 2013. This is a wide-ranging discussion of the green movement today and transforming finance with Hazel Henderson.