0251

Ron Paul – Amazing progress has been made in Congress

on the move to audit the Fed.

Reforming The World Bank – Examines the structure and workings of the World Bank and why it is under attack from all quarters. Reforms and proposed actions. (~ 27 minutes) . From Ethical Markets miniseries on International Financial Reform, featuring John Perkins, Kenneth Rogoff and Sakiko Fukudu-Parr.

Renegade Economist US Special with Dr. Michael Hudson provided by renegadeeconomist.com/video; The Renegade Economist goes to New York to hear Dr. Michael Hudson’s views on the state of the US Economy.

The Renegade Economist Talkshow – July 10th provided by renegadeeconomist.com/video; weekly updates from Fred Harrison, the renegade economist, interviewd by Ross Ashcroft.

State of the Future – Reviews the 15 global challenges for humanity to make the 21st century more equitable and environmentally sustainable while incorporating women as equal partners for greater productivity. (27 minutes)

Health and Wellness – Preventive approaches to health now competing with the current over-priced, over-prescribing, interventionist medical-industrial complex costing 16% of US GDP. This is twice what other rich countries pay with no better outcomes. A look at reforms and alternative health options. (~ 27 minutes)

Explaining Simpol provided by www.Simpol.org; John Bunzl describes how a “Simultaneous Policy” toward a package of measures to be implemented by all governments simultaneously to address global problems is the best way to overcome the obstacles that the global competitive system impose on any government that acts alone to try and resolve such problems, effectively making its country uncompetitive.

The Story of Stuff – provided by The Story of Stuff, Annie Leonard looks at the underside of production and consumption patterns, exposing the connections between a huge number of environmental and social issues. It’ll teach you something, make you laugh, and it just may change the way you look at all the stuff in your life forever. (20 min)

The Story of Stuff – provided by The Story of Stuff, Annie Leonard looks at the underside of production and consumption patterns, exposing the connections between a huge number of environmental and social issues. It’ll teach you something, make you laugh, and it just may change the way you look at all the stuff in your life forever. (20 min)

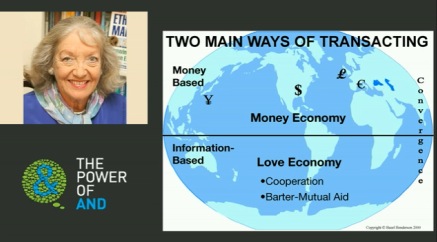

Hazel Henderson on Re-Designing Money Systems – provided by Ethical Markets Media; Presented to the launch of the UNEP Green Economy Initiative, Geneva, Dec. 1, 2008, Hazel Henderson explains how re-designing money systems can reduce greenhouse gas emissions and accelerate the growing green economy. The full paper and editorials covering these topics in greater depth are available at www.EthicalMarkets.com. (35 min)

The Story of Cap and Trade provided by The Story of Stuff Project; Intended as a conversation starter, this video, in the style of The Story of Stuff, is a fast-paced, fact-filled, look at the most popular climate solution being discussed. Annie Leonard introduces the people at the heart of this scheme – energy traders and Wall Street financiers – and examines the “devils in the details”: free permits to big polluters, fake offsets and, distractions from what’s really required to tackle the climate crisis.

Should Economists Declare Conflicts of Interest? Provided by TheRealNews.com — Gerald Epstein: Study shows many economists who testify or write on finance do not reveal they work for financial institutions.

Dennis Kucinich on Monetary Policy provided by American Monetary Institute; Kucinich compliments Steve Zarlenga, author of the Lost Science of Money. November 2008 (3 min)

Spellcasters provided by the World Business Academy; A project of the EthicMark®, founded by Hazel Henderson, this video reveals how corporations and political candidates are using MRIs, EEGs, and other brain-scan technology to craft irresistible media messages designed to shift buying habits, political beliefs, and voting patterns. Individuals can sign the petion or companies take the pledge against neuromarketing at www.worldbusiness.org.

Obama’s Challenge: Making Change without Money provided by Edgar Cahn and Chris Gray, Sally Goerner, Gwendolyn Hallsmith, and Bernard Lietaer; discusses local level change using complementary currencies to create and retain jobs, produce housing, provide health care and elder care, and reduce emissions driving climate change. “We don’t need lots of federal funding and major policy change – we just need to mobilize using old-fashioned community organizing skills.”

Ripping off the Public Provided by Brasscheck.tv; In his own words: in the first segment, Jim Kramer preaches free enterprise and paints a rosy picture of stock trading for amateurs. In the second, he instructs hedge funds on the fine points of how to sway the public by creating false signals in the market.

US Dollar as World Reserve Currency in Jeopardy provided by Reuters; Currency specialist Avinash Persaud, a member of a UN panel of experts, told the Reuters Funds Summit in Luxembourg that the panel may recommend that the world ditch the dollar as its reserve currency in favor of a shared basket of currencies, adding to pressure on the dollar. The proposal is to create something like the old Ecu, or European currency unit, that was a hard-traded, weighted basket.

James Robertson – It’s Our Money Anyway provided by The Renegade Economist; James Robertson talks frankly about democratising our money supply. Money as debt is not sustainable. www.renegadeeconomist.com

How to Create 18 Million Jobs Part 2 — provided by The Real News Network; Robert Pollin explains that reaching 4% unemployment by 2012 is possible but “normal” or “natural” pace might push that date to 2018.

Carbon Caps – Who Gets the Cash? provided by TheREalNews.com; James Boyce of PERI – The Political Economy Research Institute and professor at University of Massachusetts, Amherst, discusses the different models of carbon cap legislation and how they serve different interests. Feb. 8, 2010.

Adair Turner on GDP — provided by INET; Britain’s Lord Adair Turner, head of their Fiancial Services Authority on what’s wrong with gdp!

Goldman Sucks – provided by Lebed.biz; a visualization of Matt Taibbi’s “The Great American Bubble Machine”

Make Markets Be Markets — provided by the Roosevelt Institute: “The best advice on Reforming Finance yet from inside The Economics Box.” – Hazel Henderson, Editor. This portion of the video shows a roundtable of speakers such as Elizabeth Warren, Joseph Stiglitz and George Soros. The full report and entire video available at www.makemarketsbemarkets.org.

Michael Hudson with the Renegade Economist provided by The Renegade Economist; The Renegade Economist caught up with former Wall Street consultant Dr. Michael Hudson. He talks explicitly about the solutions, which would rescue the global economy and create a sustainable financial system. www.renegadeeconomist.com’

Wall Street Green Trading Summit 2009 provided by Ethical Markets; our reporter catches up with investment leaders and our own advisory board members attending this pivotal summit.

Dylan Ratigan reporting on Lehman Brothers – provided by MSNBC; Ratigan explains how repo transactions work and why Lehman Brothers might be criminal in their actions. Guest: Eliot Spitzer, former governer of New York

Canada Index of Wellbeing — provided by CIW; Keynote speech by The Honourable Roy J. Romanow, Chair, CIW Advisory Board.

Selling-Out Debate at Investor’s Circle 2009 provided by Ethical Markets Media; Judy Wicks, Mark Albion and Pierre Ferrari tackle the big issues of scaling a mission-driven business at the Investor’s Circle Spring 2009 Conference in San Francisco.

To Rob a Country, Own a Bank — provided by The RealNews Network; Part 3 of this ongoing series in which Prof. William K. Black, economics and law at Univ. of Missouri, describes the fraud in the banking system and the weak government response to protect consumers.

The Story of Bottled Water – provided by the Story of Stuff Project; Annie Leonard makes the obvious connection between water and manufactured demand, explaining how manufacturers get us to buy more than half a billion bottles of water every week when we can get it almost free from just-as-good (often better) tap!

Icelanders using the F word — provided by RUV; UMKC in Iceland: interview with Professor William Black discussing the commission report detailing endemic control fraud at Iceland’s Big 3 banks (only the first minute is in Icelandic).

Nassim Taleb on May 6 Wall Street Selloff—provided by Bloomberg; Nassim Taleb, NYU professor and author of “The Black Swan” talks with Bloomberg about the May 6 stock market selloff and the drivers for the financial crisis, the U.S. economy and the performance of Treasury Secretary Timothy Geithner and Federal Reserve Chairman Ben Bernanke.

Tim Nash – provided by the Lang & O’Leary Exchange; Timothy Jack Nash, president of Strategic Sustainable Investments and sustainability research coordinator of Ethical Markets Media, discusses the growing investments in the green economy, including the Green Transition Scoreboard.

Money & Life — provided by StormCloud Media; In this trailer, director Katie Teague introduces some of the many thoughtful voices calling for a change in our relationship to money. Movie release expected Fall 2011. For more information visit http://www.moneyandlifemovie.com/.

Regulating derivatives could lower price of food — provided by the TheRealNews.com; Robert Pollin, Professor of Economics at the University of Massachusetts in Amherst, describes how unregulated speculation in food and oil are major factors in creating food and energy price bubbles.

Cap-and-trade won’t cut it provided by The Real News Network; With Obama support, the House Energy and Commerce Committee plan to reduce greenhouse gas emissions in the US calls for the creation of a cap-and-trade market. James Handley from the Carbon Tax Center believes that cap-and-trade is a flawed system made worse by way of concessions to energy companies, big coal in particular. According to Handley, the bill is unlikely to achieve needed emission cuts, likely to create serious financial instability, and incapable of protecting the most vulnerable from its intended hike in energy prices.

Cap-and-trade won’t cut it, pt. 2 provided by The Real News Network; The Waxman-Markey bill, the Democratic Party’s climate change legislation, promises to reduce US emissions by 17% by 2020, and 83% by 2050. These numbers however, do not account for a practice known as carbon offsetting. Payal Parekh from International Rivers believes that the practice is counterproductive at best, serving to delay necessary energy generation changes, or dangerous at worst, putting communities at risk from megaprojects. Furthermore, offsets are unknown as a financial entity, and have already shown themselves in Europe to be candidates for financial speculation.

“Spin” by Brian Springer – Using the 1992 presidential election, documentary filmmaker Brian Springer captures the behind-the-scenes maneuverings of politicians and newscasters in the early 1990s. Pat Robertson, Al Gore, George Bush gaffes are shown — all presuming they’re off camera. Composed of 100% unauthorized satellite footage, Spin is a surreal expose of media-constructed reality. Coupled with Alan F Kay’s Spot the Spin, one is led to wonder how much truth is in politics.

William Black on Banking Rackets and Financial Fraud — provided by the Keiser Report; William Black helped send more than 1,000 criminal bankers to jail in the 80s for their part in the $150 billion S&L crisis. He explains how the rules for the 2008-2009 crisis hide the losses and therefore the fraud.

Nassim Nicholas Taleb on economists from YouTube; Nassim Nicholas Taleb, author of New York Times best seller Black Swan, explains what of economists’ reasoning is mistaken and counter productive.

The Money Fix — provided by Ethical Markets; on PBS stations and affiliates around the US for free download from www.epstv.com. Directed and produced by Alan Rosenblith (see full version at www.themoneyfix.org) and edited for TV by Hazel Henderson, this feature-length documentary explores our society’s relationship with the almighty dollar and examines economic patterning in both the human and the natural worlds. Most of us take the monetary system for granted, but it has a profound and largely misunderstood influence on our lives. The film documents alternative money systems which help solve economic problems for the communities in which they operate.

Joseph E. Stiglitz: Financial Crisis & Global Development provided by MaximsNews Network, Feb. 2009; Nobel Laureate Stiglitz, speaking at the U.N. Dag Hammarskjold Auditorium, characterizes the global crisis as having a “made in the USA label” and states that the US exported its deregulatory philosophy, its “toxic mortgages” and, now, the recession.

Michael Lewis: The End of Wall Street provided by Fora.tv; Michael Lewis, the author of Liar’s Poker and Panic: The Story of Modern Financial Insanity, speaks about the excess political influence of Wall Street before the Hudson Union Society.

Emerging Measures of Qualitative Growth — provided by Sustainable Brands 2010; Hazel Henderson re-defines the metrics by which nations measure success beyond GDP