0388

Austerity and the Destruction of Democracy – provided by theRealNews.com; Rob Johnson: Austerity policies in Europe threaten a deformation of democracy and the rise of ultra-nationalist forces

Austerity and the Destruction of Democracy – provided by theRealNews.com; Rob Johnson: Austerity policies in Europe threaten a deformation of democracy and the rise of ultra-nationalist forces

Renegade Economist US Special with Dr. Michael Hudson provided by renegadeeconomist.com/video; The Renegade Economist goes to New York to hear Dr. Michael Hudson’s views on the state of the US Economy.

Government by Goldman Sachs, provided by Rolling Stone; reporter Matt Taibbi explains how deeply influential the banking industry is and has been with Congress and every administration since the 1990s, democrats and republicans alike.

Monitoring the Impact of Crisis in Real Time provided by the United Nations; showcases the United Nations Secretary-General’s initiative on Global Impact and Vulnerability Alert System to monitor the impact of crisis in real-time.

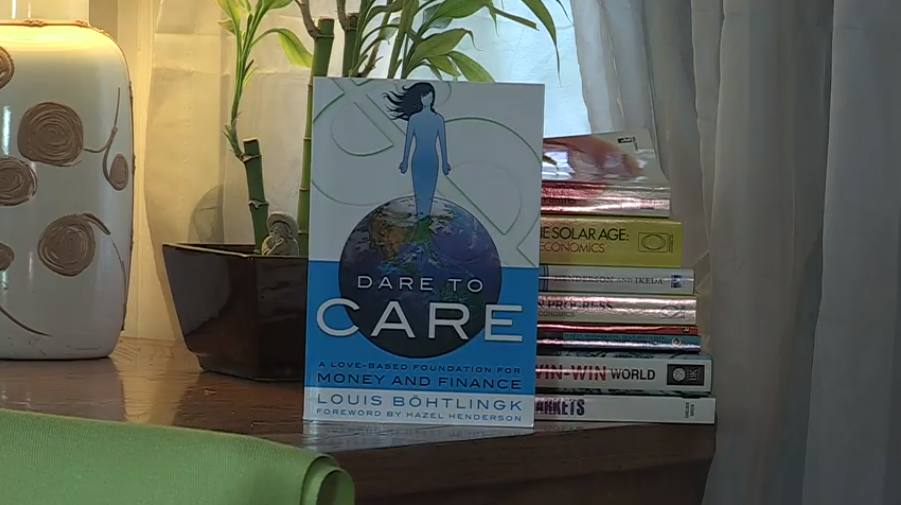

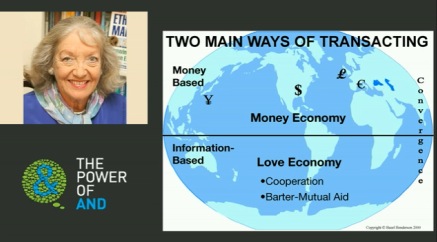

“Daring to Care: Growing the Love Economy” – Interview with Louis Böhtlingk – Founder, Care First World; author, Dare to Care; Ethical Markets Transforming Finance Series 2013

“Daring to Care: Growing the Love Economy” – Interview with Louis Böhtlingk – Founder, Care First World; author, Dare to Care; Ethical Markets Transforming Finance Series 2013

Ellen Brown – Financial meltdown: Why it happened, How it can be reversed provided by Democracy for America; Ellen Brown, author of Web of Debt, explains the roots of the current economic crisis and a way out. Brown’s articles are regularly posted at www.ethicalmarkets.com. Her presentation begins about 11 1/2 minutes into the video. Worth the wait!

Money – Jane D’Arista — provided by The Real News Network; Quantitative Easing, TARP and more! Interview with Jane D’Arista, of the Political Economy Research Institute. Begins at the 2:45 mark.

“Vision of the Future – Hazel Henderson” – provided by PeaceGlobalNet; a broad view of the process of Human Evolution and our present day opportunities. Interview with Hazel Henderson, Futurist – International Speaker – Writer

“Making Ethical Investing the New Norm” — Discussion with MARIANA BOZESAN, Founder & General Manager of AQAL Capital GmbH, and GARVIN JABUSCH, cofounder and chief investment officer of Green Alpha ® Advisors, and Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

“Rating the Rating Agencies” — Discussion with Claudine Schneider, Congresswoman, US House of Representatives (R-RI), 1980-1990,Lawrence Bloom, FRICS, Co-Founder & Chairman, B.e Energy, and Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

Speculation and Frenzy in Food Markets — provided by TheRealNews.com; Jayati Ghosh, professor of economics at JNU university in New Delhi and executive secretary of International Development Economics Associates, and Robert Pollin, professor of economics and codirector of the Political Economic Research Institute, PERI, discuss an avoidable crisis.

US Dollar as World Reserve Currency in Jeopardy provided by Reuters; Currency specialist Avinash Persaud, a member of a UN panel of experts, told the Reuters Funds Summit in Luxembourg that the panel may recommend that the world ditch the dollar as its reserve currency in favor of a shared basket of currencies, adding to pressure on the dollar. The proposal is to create something like the old Ecu, or European currency unit, that was a hard-traded, weighted basket.

James Robertson – It’s Our Money Anyway provided by The Renegade Economist; James Robertson talks frankly about democratising our money supply. Money as debt is not sustainable. www.renegadeeconomist.com

BerkShares Local Currency on BBC provided by the E.F. Schumacher Society and the BBC; BerkShares local currency supports the community, economy, ecology, and sustainability of the southern Berkshire region of Massachusetts. Launched by the E. F. Schumacher Society, BerkShares create consumer awareness about the consequences of spending practices, supports local businesses, facilitates the development of import replacing industries, and serves as a model for other regions.

In this program, Hazel Henderson and Wayne Silby, lawyer and founder of the Calvert Group of socially responsible mutual funds discuss where these investing trends Silby pioneered , are heading. They discuss how these trends evolved , as both were colleagues at Calvert from its launch in 1982 , when Henderson served on Calvert’s Advisory Council with other experts , helping develop Calvert’s social screens . These screens helped steer portfolios away from companies with poor records on pollution, mistreatment of employees, alcohol, tobacco, weapons makers toward the cleaner, greener ethical portfolios of many hundreds of similar funds today. Both agree that these investment vehicles, whether still called “ triple bottom lineâ€, SRI, ESG , ethical, or “green†are now mainstream, with their value-based metrics offered by Morgan Stanley’s MSCI group. . These funds are now often re-branded more broadly as “ impact investing “ seen as more acceptable , and are now offered by mainstream firms from Blackrock and Goldman Sachs to Bank of America . Other terms include “ sustainable “ , all widening the market for these funds. Thus, the issue going forward is to monitor these mainstream funds , their values , mission statements and portfolio choices and performance to avoid “ greenwashing “ !

In this program, Hazel Henderson invites her longtime colleague Wayne Silby , founder of the Calvert Group of socially-responsible mutual funds, to share his personal story . Wayne reminisces on how he became involved in pioneering ethical investing . He describes his personal evolution from a successful currency fund manager , to questioning what he really wanted on his tombstone ! After founding Calvert in 1982 and steering the fund for decades , Wayne launched his Syntao company in Beijing China , foreseeing today’s China, now the second largest economy in the world , which is set to overtake the USA in the next decade due to its vast population and rapid innovation. Syntao brings Wayne’s investing model to China , now in many cities there , with 60 Chinese employees. Wayne now divides his time between homes in Washington, DC and Beijing . He still chairs the Calvert Foundation and a new donor-advised philanthropic fund , ImpactInvest — and has no plans to slow down anytime soon !

Michael Hudson with the Renegade Economist provided by The Renegade Economist; The Renegade Economist caught up with former Wall Street consultant Dr. Michael Hudson. He talks explicitly about the solutions, which would rescue the global economy and create a sustainable financial system. www.renegadeeconomist.com’

Reforming Global Finance –Videos showing solutions to the global economic crisis that break from the old paradigms and offer a different relationship to money, banking, debt, currency and our measure of wealth.

Reforming Global Finance –Videos showing solutions to the global economic crisis that break from the old paradigms and offer a different relationship to money, banking, debt, currency and our measure of wealth.

In this program Hazel Henderson explores with Linda Crompton MBA, CEO of Leadership Women-USA how women open up new opportunities and innovate in business finance and politics. They discuss both bad and good news on gender issues in many fields including opportunities to positively impact mass media content and advertising.

With Teresa Radzinski, MBA

US Trust-Bank of America

In this program Hazel Henderson explores with Teresa Radzinski, MBA, Managing Director,

U. S.Trust-Bank of America Private Wealth Management, their special portfolios designed for ethical, responsible investors. These portfolio’s are geared to meet the values of investors who are concerned with social, environmental and governance issues, including gender equity, diversity, climate change and carbon-free goals. They discuss the 30 year evolution of these kinds of innovative portfolios now going mainstream under the new branding of “impact funds”. These are especially appealing to women and millennial investors.

With Teresa Radzinski, MBA

U.S. Trust Bank-Bank of America

In this program, Hazel Henderson and Teresa Radzinski, MBA, Managing Director,

U. S. Trust-Bank of America Private Wealth Management share stories on how women became prominent in finance and business.

They discuss the challenges and opportunities women face and the recent studies that show women out-performing in portfolio management, leaders in ethical investing and how corporations lead by women often exceed benchmarks in performance and results. Teresa tells about her innovative clients who are courageous nuns speaking out and serving the poor, while taking charge of their own pension investments.

In this program Hazel Henderson explores with Dr. Monica Sharma, author of Radical Transformational Leadership (2018) her personal story growing up in India. How she practiced medicine there and grew to understand the importance for human health of looking at her patients’ life circumstances and their environments. Dr. Sharma became a leader in many United Nations health initiatives and her leadership style can inspire and empower many others.

“Your Money Or Your Life”

with author Vicki Robin

In this program Hazel Henderson discusses with author Vicki Robin how the financial markets have changed since her book “Your Money or Your Life”, originally co-authored with Joe Dominguez, was first published in 1993. This perennial best-seller was updated again by Vicki Robin in 2018 and found a new audience of half a million millennial followers. Vicki describes how investing has changed to focus more locally and personal growth an achievements. Vick’s new fame includes interviews in the Wall Street Journal, The New York Times and the cover of Money Magazine.

“Blessing the Hands That Feed Us”

with author Vicki Robin

In this program Hazel Henderson discusses with author Vicki Robin the unsustainable global food system and reforms needed, described in her book “Blessing the Hands That Feed Us”. Vicki describes how locally-grown organic foods are a growing segment worldwide and offer better nutrition as well as more secure livelihoods for farmers. Opportunities are discussed on all the ways our unsustainable global agro-chemical industrial complex with its narrow mono-culture crops in global trade are feeding perilously on the planet’s 3% of freshwater. Meanwhile all the hundreds of salt tolerant food plants that grow in 22 countries on desert lands can be added, along with many other overlooked native plants, as well as all the startups in plant-protein foods offering better nutrition for the growing vegetarian consumer markets.

Nassim Taleb on May 6 Wall Street Selloff—provided by Bloomberg; Nassim Taleb, NYU professor and author of “The Black Swan” talks with Bloomberg about the May 6 stock market selloff and the drivers for the financial crisis, the U.S. economy and the performance of Treasury Secretary Timothy Geithner and Federal Reserve Chairman Ben Bernanke.

2012: The Day After part 1 — provided by M-CAM; Professor David Martin explains what evolving markets will look like in a world that is not bound by scarcity.

2012: The Day After part 2 — provided by M-CAM; Professor David Martin explains what evolving markets will look like in a world that is not bound by scarcity.

Analysis of Adam Smith Economics to modern day part 1 – provided by M-CAM; Professor David Martin of M-CAM and the University of Virginia’s Darden Graduate School of Business Administration.

Analysis of Adam Smith Economics to modern day part 2 – provided by M-CAM; Professor David Martin of M-CAM and the University of Virginia’s Darden Graduate School of Business Administration moves on to discuss other economic theories, such as Keynesian, applied to the 21st century.

Money As Debt III — provided by Paul Grignon; preview for “Evolution Beyond Money”, a video which illustrates in extensive and entertaining detail how a fundamental change in our long-held concept of money, paired with recent breakthroughs in technology, opens the door to a liberated, self-balancing global “money” backed by Real Value and Open to All.

Roundtable on Sustainable Development – provided by TheRealNews.com; At the Bretton Woods, INET conference, hundreds of economists gathered to come up with new economic thinking, trying to find a way out of the economic crisis while asking just how much growth can the planet sustain? Speakers include John Fullerton, founder and president of Capital Institute, a think tank working on these questions; William Rees, professor and ecologist at the University of British Columbia; Peter Brown, professor at the School of Environment at McGill University, and Juliette Shor, economist and sociologist at Boston College.

Nassim Nicholas Taleb on economists from YouTube; Nassim Nicholas Taleb, author of New York Times best seller Black Swan, explains what of economists’ reasoning is mistaken and counter productive.

Nassim Taleb and Daniel Kahneman: Reflection on a Crisis provided by Fora.tv; Nassim Taleb and Nobel Laureate Daniel Kahneman discuss the economic crisis of 2008-2009 in terms of economists’ unfounded expectations.

Why Save the Euro? – provided by TheRealNews.com; Mark Weisbrot, American economist, columnist and co-director of the Center for Economic and Policy Research (CEPR) in Washington, D.C, explains how the Euro is flawed and how the European Union will survive, with or without it.

Joseph E. Stiglitz: Financial Crisis & Global Development provided by MaximsNews Network, Feb. 2009; Nobel Laureate Stiglitz, speaking at the U.N. Dag Hammarskjold Auditorium, characterizes the global crisis as having a “made in the USA label” and states that the US exported its deregulatory philosophy, its “toxic mortgages” and, now, the recession.

Austerity and the Destruction of Democracy — provided by TheRealNews.com; Rob Johnson: Austerity policies in Europe threaten a deformation of democracy and the rise of ultra-nationalist forces

Emerging Measures of Qualitative Growth — provided by Sustainable Brands 2010; Hazel Henderson re-defines the metrics by which nations measure success beyond GDP