0003

Growing the Green Economy – Long dismissed by mainstream media, visionary entrepreneurs, environmentalists, scientist and professionals have been creating an economy that thrives in harmony with the earth and social well-being. With insight and clarity, this show looks at the green economy that already exists and is growing by leaps and bounds! (~ 54 minutes)

0068

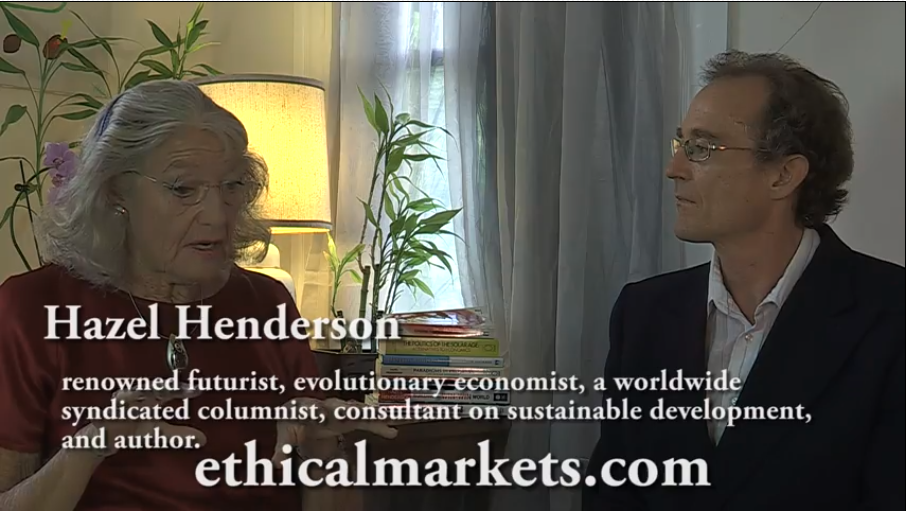

The Money Fix – Provided by The Money Fix, Hazel Henderson discusses the current ineffective methods of measuring true wealth and the inappropriate use of money, giving examples like the false Nobel Prize in Economics. (~ 9 minutes)

0100

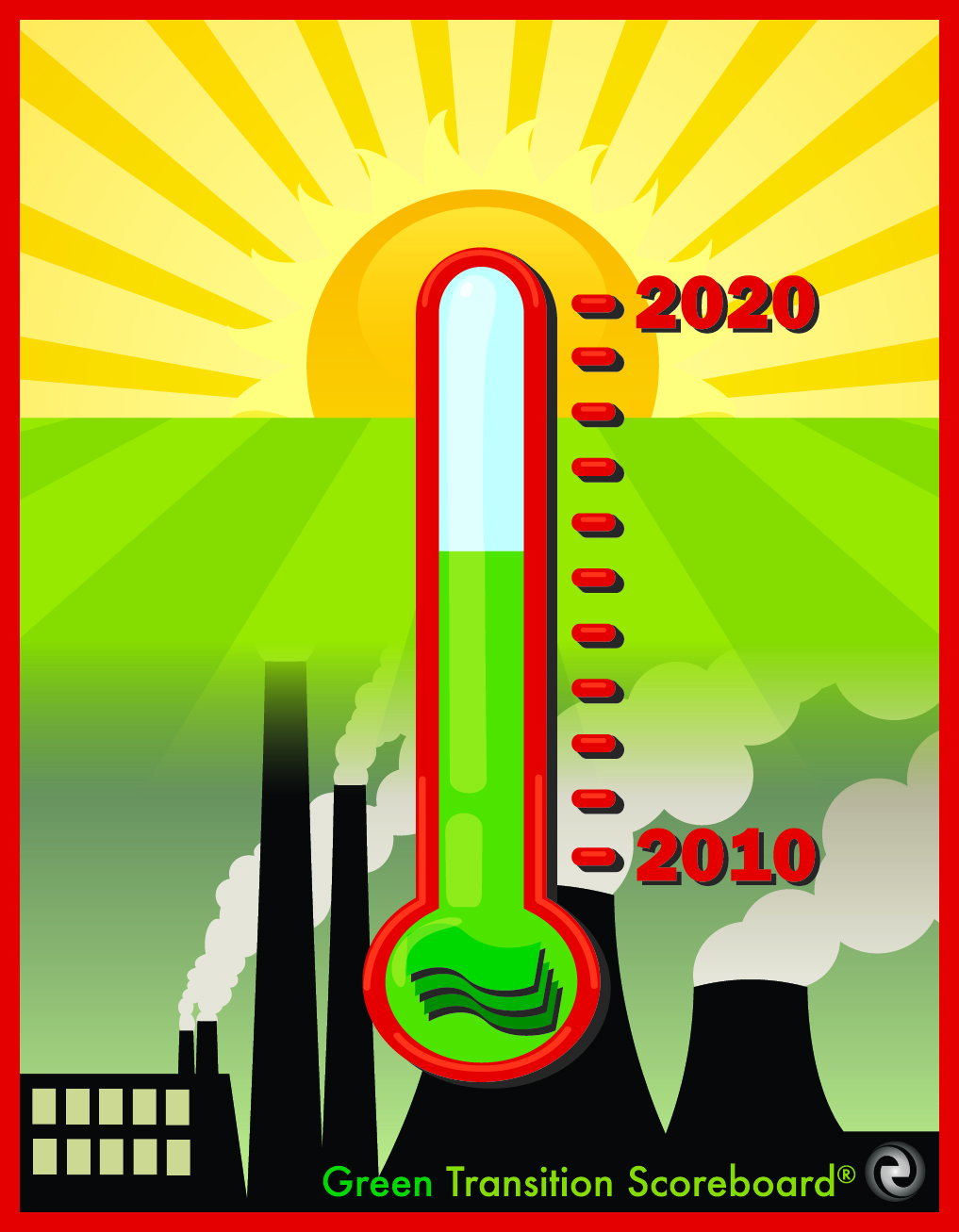

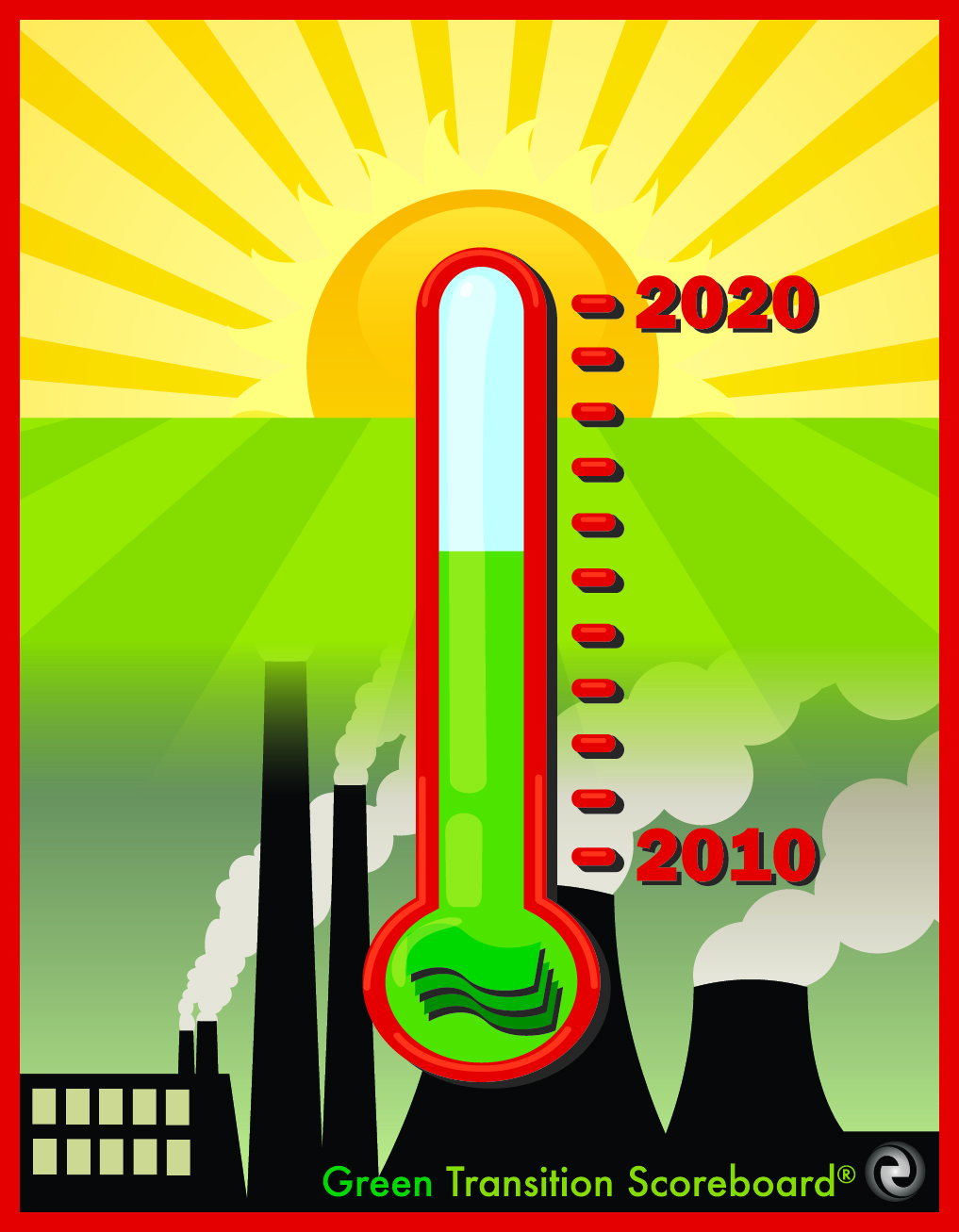

Green Transition Scoreboard(r) Explained – scripted and narrated by Hazel

Henderson, Ethical Markets Media (c) 2014

814 – “The Future of Energy” with NASA Chief Scientist, Dennis Bushnell, Langley, VA

In this program, Hazel Henderson and NASA Chief Scientist Dennis Bushnell review all the issues around the increasing global shift from polluting fossil fuels and their effect on climate to economies. They discuss today’s harvesting of solar, wind, geothermal, hydro and oceans, as well as the cost savings from more efficient buildings, batteries electric vehicles and charging stations, smarter cities and urban design, public transport and the future of decentralized energy, especially in developing countries. Both Henderson and Bushnell agree that there is ample renewable energy from our Sun for all existing and foreseen human societies’ needs. The issues concern the politics of incumbent interests and the re-design of green infrastructure so as to utilize and scale up all our existing renewable technologies now available, as tracked in the Green Transition Scoreboard ®.

0333

The Money Fix — provided by Ethical Markets; on PBS stations and affiliates around the US for free download from www.epstv.com. Directed and produced by Alan Rosenblith (see full version at www.themoneyfix.org) and edited for TV by Hazel Henderson, this feature-length documentary explores our society’s relationship with the almighty dollar and examines economic patterning in both the human and the natural worlds. Most of us take the monetary system for granted, but it has a profound and largely misunderstood influence on our lives. The film documents alternative money systems which help solve economic problems for the communities in which they operate.

0018

Socialy Responsible Investing – Covers the worldwide boom in ethical investing ($2.3 trillion in the USA alone). Social and environmental costs (pollution, outsourcing, stagnate wages) of maximizing profits to shareholders has given way to concerns for all stakeholders and new “triple bottom line” accounting for people, planet and profits. (~ 27 minutes)

0017

Health and Wellness – Preventive approaches to health now competing with the current over-priced, over-prescribing, interventionist medical-industrial complex costing 16% of US GDP. This is twice what other rich countries pay with no better outcomes. A look at reforms and alternative health options. (~ 27 minutes)

0016

Clean Food – Surveys the explosive growth of organic agriculture in the face of consumer fears of tainted and imported foods. Locally-grown, fresh, organic food, free of pesticides, farmers’ markets and local contract agriculture are seen as the future. (~ 27 minutes)

0015

Transformation Of Work – Views rapid changes in workplaces, outsourcing, automation and self-employment, focusing on employee-owned companies (11,000 in the USA) and the prospects for democratizing capital-ownership. (~ 27 minutes)

0014

Shareholder Advocacy – Interviews with activist-shareholders pushing their companies to be more socially and environmentally responsible. Corporate managers are responding as active investors join with employees, unions, environmentalists and many other stakeholders to push for higher ethical standards. (~ 27 minutes)

0013

Renewable Energy – Renewable energy: solar, wind, biofuels, hydrogen, ocean power are the best route beyond fossil fuels to energy independence. A look at the technologies and the leaders in this “green revolution.” (~ 27 minutes)

0012

Woman Owned Businesses – In the USA, 50% of all private companies are owned and managed by women and employ 19 million Americans. Women’s goals differ from those of men: women rate profit-maximizing below other community, family and personal values. We meet many women business leaders, bankers and entrepreneurs. (~ 27 minutes)

0011

Fair Trade – “Free trade” has turned into a free-for-all based on cutting prices, cutting corners on safety, quality and the environment – as well as outsourcing of production and jobs to lowest-wage countries. Fair trade labels on products growing to ensure consumers that small organic producers of coffee, teas, chocolate and many other foods get fair prices. (~ 27 minutes)

0010

Investing In Your Community – Some of your safest, best investments are right outside your door! A look at successful community investing in growing, vibrant local economies, affordable housing, new small businesses and re-development. (~ 27 minutes)

0009

Green Building and Design – The revolution in building, architecture, product design is leading to the explosive growth of energy-efficient, less polluting, safer and healthier workplaces and homes. (~ 27 minutes)

0007

Global Corporate Citizenship – More ethical “corporate citizenship” now seen as a must by many leaders and critics. Best practices of corporations in consumer and environmental protection, human and workplace rights. (~ 27 minutes)

0006

Redefining Success – Changing scorecards of countries’ “progress” beyond money and Gross National Product (GDP) to new indicators of Quality of Life and Gross National Happiness. (~ 27 minutes)

0008

Ethical Markets: The Non-money Economy – Over 50% of all production of goods and services in all countries is ignored because it is unpaid. A look at this “love economy” – raising children, caring for families, the elderly and sick, volunteering – is estimated at over $16 trillion worldwide missing from global GNP. (~ 27 minutes)

398 – Promo – “Green Banking and Investing”

Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 2013

399 – Promo -“Nurturing Sustainable Local Communities Worldwide”

“Nurturing Sustainable Local Communities Worldwide” – Interview with Steven Lovink – Founder/CEO, Planet2025 Network and Power of One; Ethical Markets Transforming Finance Series 2013

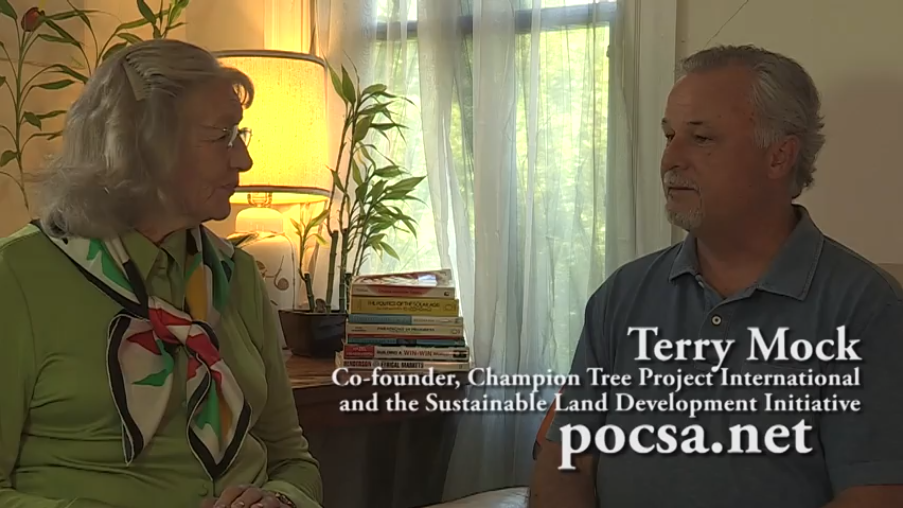

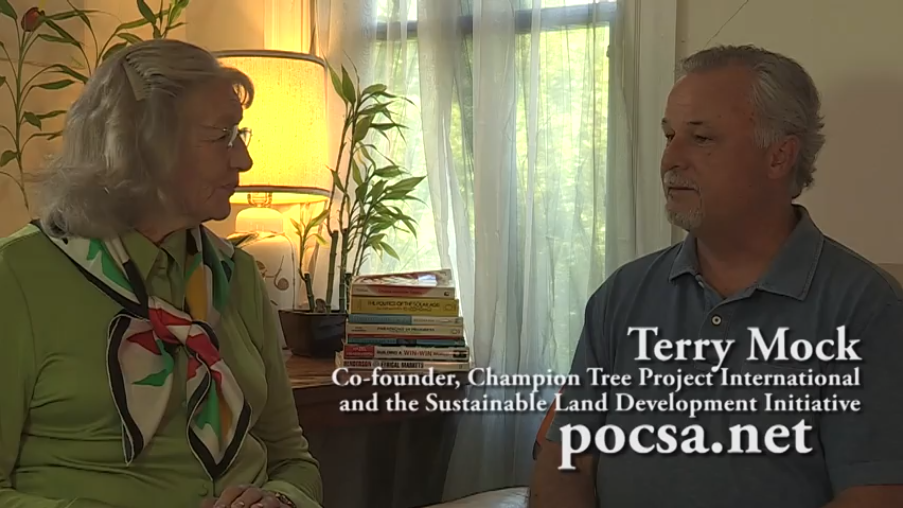

400 – Promo – “Permaculture, Eco-forests Developing Green Economies”

“Permaculture, Eco-forests Developing Green Economies”

Terry Mock – Co-founder, Champion Tree Project International and the Sustainable Land Development Initiative; Ethical Markets Transforming Finance Series 2013

401 – Promo – “Financing the Green Transition to the Coming Solar Age”

“Financing the Green Transition to the Coming Solar Age”

Peter Lynch – Private Investor and Financial/Technology Advisor to Investors; former senior editor, Photovoltaic Insider Report; Ethical Markets Transforming Finance Series 2013

402 – Promo – “Healthy Foods, Healthy Lifestyles: Paths to Happiness”

“Healthy Foods, Healthy Lifestyles: Paths to Happiness”

Martin Ping – Executive Director, Hawthorne Valley Association, Ethical Markets Transforming Finance Series 2013

403 – Promo – “Strengthening Locally Owned Independent Finance”

“Strengthening Locally Owned Independent Finance”

David Rose – Founder and CEO, Unified Field Corporation; Creator, Unified Field Bank™, Ethical Markets Transforming Finance Series 2013

404 – Promo – “Fostering Homegrown Reliable Economies”

“Fostering Homegrown Reliable Economies”

Stuart Valentine – Principal, Centerpoint Investment Strategies, Ethical Markets Transforming Finance Series 2013

0343

Financing Clean Development – interview with Graciela Chichilnisky, “Transforming Finance” — an Ethical Markets Media production © 2010

0344

Private Financing of Green Companies – interview with Karl Kleissner, “Transforming Finance” — an Ethical Markets Media production © 2010

409 – “Daring to Care: Growing the Love Economy” – Interview with Louis Böhtlingk

“Daring to Care: Growing the Love Economy” – Interview with Louis Böhtlingk – Founder, Care First World; author, Dare to Care; Ethical Markets Transforming Finance Series 2013

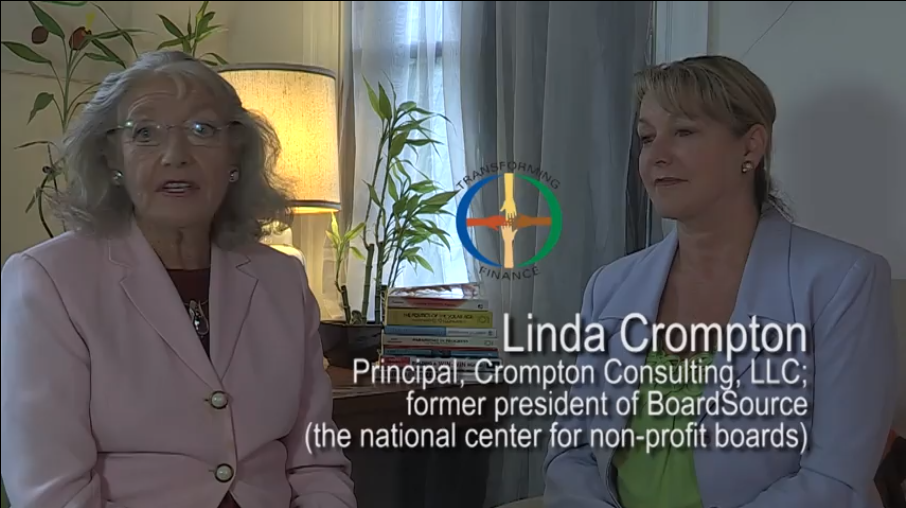

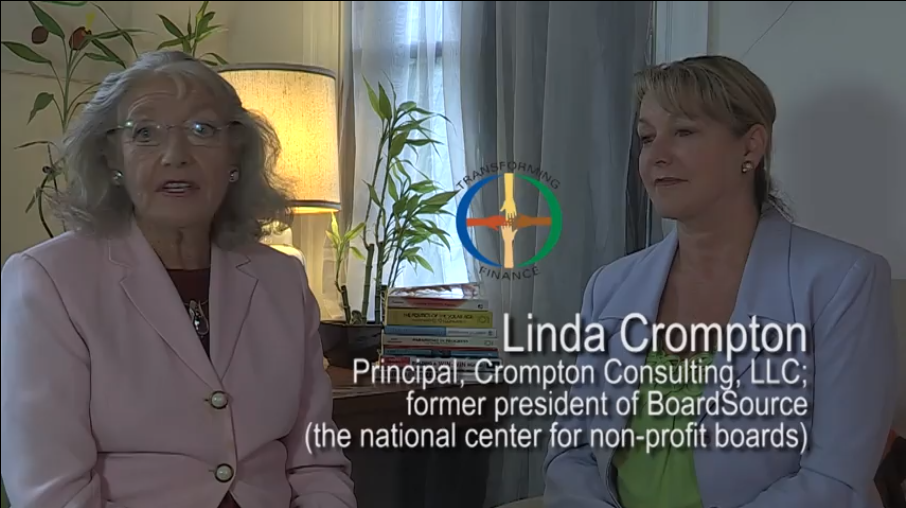

410 – “Recognizing the Power and Purpose of Non-profits” – Interview with Linda Crompton

“Recognizing the Power and Purpose of Non-profits” – Interview with Linda Crompton – Principal, Crompton Consulting, LLC; former president of BoardSource (the national center for non-profit boards); Ethical Markets Transforming Finance Series 2013

0345

Greening of Pension Funds interview with Bryan Martel, “Transforming Finance” — an Ethical Markets Media production © 2010

0347

Steering Capital Toward Sustainability interview with John Fullerton, “Transforming Finance” — an Ethical Markets Media production © 2010

0348

Finance is a Global Commons interview with Leo Burke, “Transforming Finance” — an Ethical Markets Media production © 2010

0349

Escaping the Web of Debt – interview with Ellen Brown, “Transforming Finance” — an Ethical Markets Media production © 2010

413 – “Healthy Foods, Healthy Lifestyles- Paths to Happiness” – Martin Ping

“Healthy Foods, Healthy Lifestyles: Paths to Happiness”

Martin Ping – Executive Director, Hawthorne Valley Association, Ethical Markets Transforming Finance Series 2013

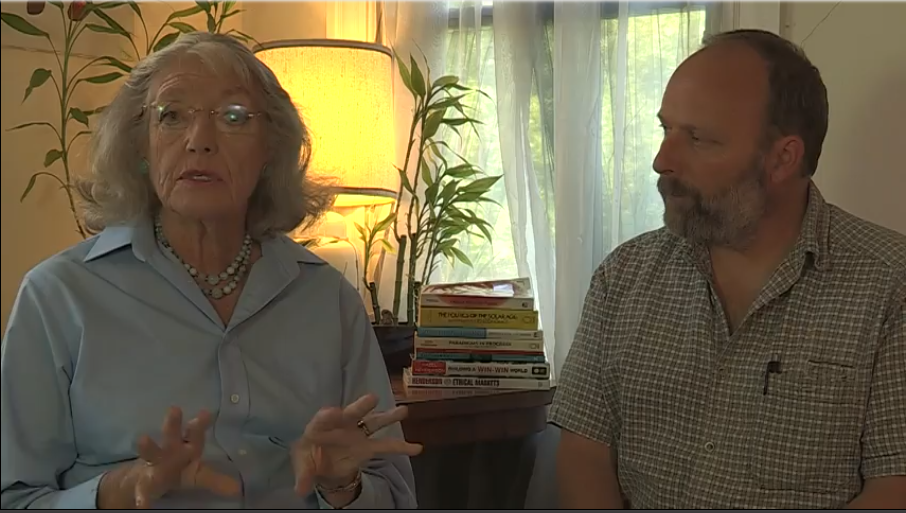

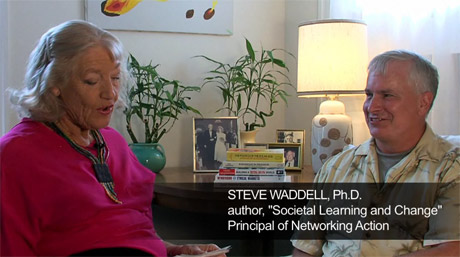

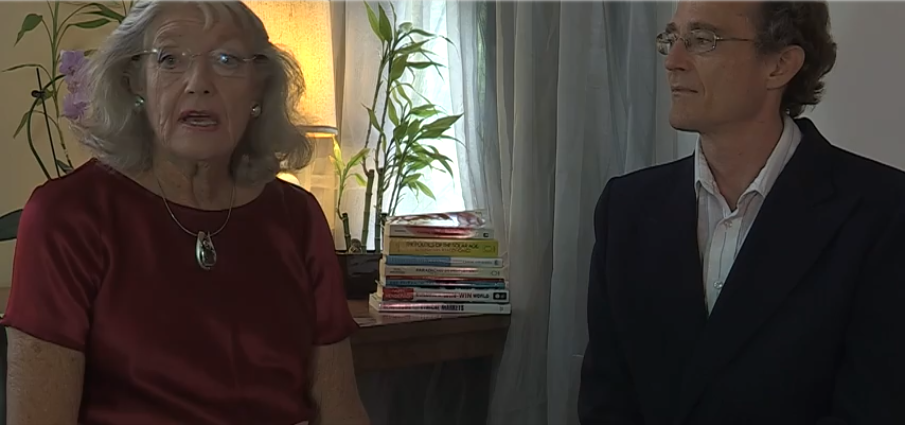

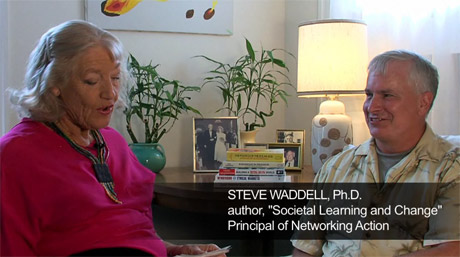

0350

Finance Should Serve Society – interview with Steve Waddell, “Transforming Finance” — an Ethical Markets Media production © 2010

414 – ““Financing the Green Transition to the Coming Solar Age” – Peter Lynch

“Financing the Green Transition to the Coming Solar Age”

Peter Lynch – Private Investor and Financial/Technology Advisor to Investors; former senior editor, Photovoltaic Insider Report; Ethical Markets Transforming Finance Series 2013

0351

China’s New Development – interview with Zhouying Jin, “Transforming Finance” — an Ethical Markets Media production © 2010

415 – “Nurturing Sustainable Local Communities Worldwide” – Interview with Steven Lovink

“Nurturing Sustainable Local Communities Worldwide” – Interview with Steven Lovink – Founder/CEO, Planet2025 Network and Power of One; Ethical Markets Transforming Finance Series 2013

416 – “Fostering Homegrown Reliable Economies” – Stuart Valentine

“Fostering Homegrown Reliable Economies”

Stuart Valentine – Principal, Centerpoint Investment Strategies, Ethical Markets Transforming Finance Series 2013

417 – “Permaculture, Eco-forests Developing Green Economies” – Terry Mock

“Permaculture, Eco-forests Developing Green Economies”

Terry Mock – Co-founder, Champion Tree Project International and the Sustainable Land Development Initiative; Ethical Markets Transforming Finance Series 2013

418 – Promo – “Green Banking and Investing” – Interview with Ken La Roe

“Green Banking and Investing” – Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 2013

419 – “Green Banking and Investing” – Interview with Ken La Roe

“Green Banking and Investing” – Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 201

425 – Beyond Economics to Earth Systems Science – Interview with Michael Grunwald

“Beyond Economics to Earth Systems Science” – Interview with Michael Grunwald – TIME, Time.com, Senior National Correspondent; author, The New New Deal (2012); Ethical Markets Transforming Finance Series 2013

420 – Transition to the Green Economy – Michael Grunwald

“Transition to the Green Economy” – Interview with Michael Grunwald – TIME, Time.com, Senior National Correspondent; author, The New New Deal (2012); Ethical Markets Transforming Finance Series 2013

422 – Investing in Desert-Greening

“Investing in Desert Greening” — Discussion with Dennis Bushnell, chief

scientist, NASA Langley; Carl Hodges, founder, Seawater Foundation, and

Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

423 – “Making Ethical Investing the New Norm”

“Making Ethical Investing the New Norm” — Discussion with MARIANA BOZESAN, Founder & General Manager of AQAL Capital GmbH, and GARVIN JABUSCH, cofounder and chief investment officer of Green Alpha ® Advisors, and Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

424 – “Rating the Rating Agencies”

“Rating the Rating Agencies” — Discussion with Claudine Schneider, Congresswoman, US House of Representatives (R-RI), 1980-1990,Lawrence Bloom, FRICS, Co-Founder & Chairman, B.e Energy, and Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

425 – “How Adam Smith and Charles Darwin Got Hijacked” – Discussion with Kim Ann

“How Adam Smith and Charles Darwin Got Hijacked” – Discussion with Kim Ann

Curtin, author, CEO, The Wall Street Coach, and Hazel Henderson, president,

Ethical Markets Media; Ethical Markets Transforming Finance Series 2014

426 – “Transforming Wall Street” – Discussion with Kim Ann Curtin, author, CEO,

“Transforming Wall Street” – Discussion with Kim Ann Curtin, author, CEO,

The Wall Street Coach, and Hazel Henderson, president, Ethical Markets

Media; Ethical Markets Transforming Finance Series 2014

785 – Reforming Capital Markets and Corporate Governance

In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, what reforms still are needed in capital markets. They review the challenges and progress over the past decades as ethical, green investing began to go mainstream which now in the USA alone comprises $6.57 trillion or 18% of total investments. Future expansion is expected as accounting reforms expose real risks such as water shortages and climate change excluded in traditional financial models

789 – Reforming Capital Markets and Corporate Governance

In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, what reforms still are needed in capital markets. They review the challenges and progress over the past decades as ethical, green investing began to go mainstream which now in the USA alone comprises $6.57 trillion or 18% of total investments. Future expansion is expected as accounting reforms expose real risks such as water shortages and climate change excluded in traditional financial models.

790 – The Future of Education

In this program, Hazel Henderson discusses with Dr. William Abare, President, Flagler College, how education is changing. They explore the growing challenges to education: costs rising faster than inflation; students bearing $1.2 trillion in loans while facing disruptive technological changes and job markets shifting globally. Traditional colleges are challenged by massive open online courses (MOOCs) such as Khan Academy, backed by Bill Gates, and other start-ups now funded by Silicon Valley capitalists, with millions of students learning free online. How can the benefits of campus-based education be extended to include more student and help counter growing inequality?

791 – The Future of Business Education

In this program, Hazel Henderson explores innovative courses with Dr. Allison Roberts, Chair of the Business Administration Department, Flagler College. They critique the values underlying much traditional business education which still teach with obsolete textbooks and assumptions that self-interest competition is “human nature”. Old courses still assume the impacts of business activities harming others and their environmental costs can be “externalized” from company balance sheets. Dr. Roberts, whose doctorate is in health and labor economics, has designed a more scientific curriculum, taking account of social and technological changes that have changed the global economy. Dr. Roberts teaches broader analyses and strategies for business success and new scorecards so that her students can prosper in the 21st century while contributing to more sustainable societies

792 – Reforming Business Education for Sustainable Economies

– In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, how business courses need to catch up with changes in today’s finance and business. They review the urgent need to reform curricula at business schools in North America and Europe. Many still are teaching from obsolete textbooks with faulty assumptions that still permit companies, financiers and governments to “externalize” the social and environmental impacts from their balance sheets and pass on the costs to taxpayers, citizens and the environment.

720 – Asia’s Challenges to Western Economies

In this program, Hazel Henderson and Asian Markets Sustainability Analyst Matthew McGarvey, both China experts, review the new challenges China poses to Western economies as well as from other emerging economies in Asia. Western economists misunderstand the restructuring in China from exports toward domestic goals and shifting from polluting coal to wind, solar and the “circular economy” and their “Green GDP.” The new Asian Infrastructure Investment Bank (AIIG) led by China has attracted members like Britain and other European countries, as well as the IMF. Yet, the US Congress refused to join and is now out in the cold. The rush to new mega-trade deals in Asia and the need for new rules and metrics are explored.

794 – Transitioning Economies Towards New Values

In this program, Hazel Henderson and Asian Markets Sustainability Analyst Matthew McGarvey, who has lived in China, Vietnam and regularly visits Asia, discuss trends toward new values beyond Western GDP-measured economic growth. Asian economics’ models tend toward the Chinese view that “markets are good servants but bad masters.” Government rule-setting and oversight are favored and often authoritarian. Matt McGarvey recounts his personal journey from growing up in America’s heartland to learning Chinese and working in Beijing, and his experiences in Vietnam and other Asian countries.

793 – Artificial Intelligence: What Happens As Machines Take Over?

In this program, Hazel Henderson and NASA Chief Scientist Dennis Bushnell discuss the new alarms raised by Bill Gates, Google’s Eric Schmidt, Space-Ex and Tesla’s founder Elon Musk and physicist Stephen Hawking that intelligent machines like IBM’s Watson may soon outsmart humans. These computer pioneers believe this could pose existential danger to human civilization – because they may not share human values and may cause us great harm. Bushnell cites all the areas where computers are already smarter and more efficient than humans: in law, medicine, accounting and will be needed in NASA’s space program. Henderson worries about the societal impacts as ever more sectors of modern economies are digitized, now displacing white collar jobs beyond earlier manufacturing automation since the 1960s. While futurists envisioned “leisure societies,” shorter work weeks, guaranteed basic incomes and flowering of culture, art and human potentials – what we got was unemployment, stagnant wages and longer work hours.

788 – Robots Taking Over: What Will Humans Do?

In this program, Hazel Henderson and NASA Chief Scientist Dennis Bushnell explore the advance of automation as ever more sectors of industrial societies are digitized: from manufacturing to retailing, accounting, healthcare, education, legal services and even finance. Driverless vehicles will end jobs in trucking, taxis, which offer millions of entry-level opportunities. Fly-by-wire airplanes have caused the deskilling of pilots, some of whom have been confused when computerized navigation systems have failed – causing crashes. Can computerized systems be programmed with human values: empathy, compassion and ethics? Can a driverless car pass an ethical test of judgment: swerving to avoid hitting a group of people at the expense of colliding with a single person? Bushnell points out how much more efficient computers are at many tasks than humans. Henderson looks at the macro-effects: how can economies maintain aggregate demand to buy all the new productivity’s goods and services? How can people obtain purchasing power if not from jobs? They discuss alternatives emerging: worker-owned companies, cooperative enterprises and guaranteed basic incomes now enacted in Brazil, Mexico and proposed in Switzerland, Europe and the USA.

786 – Privacy in the New Media Age: Part I

– In this program, Hazel Henderson explores with law professor Jon L. Mills, former speaker in Florida’s House of Representatives, his current book, Privacy in the New Media Age. The Internet, social media, blogs, “citizen-journalists” and global news distribution pose thorny issues in all countries. While the USA favors free speech over individual rights to privacy, European countries are protecting people’s “right to be left alone” and the deletion of old records of individual behavior which may jeopardize their future employment. While Facebook and Twitter facilitated the grassroots protests and rebellions of the “Arab Spring,” these social media also helped police to track down the dissidents and their prosecution. Prof. Mills points out that technological innovations always outrun the pace of law and public responses. Different rules apply in many countries and global agreements may take decades.

787 – Privacy in the New Media Age Versus the First Amendment: Part II

– In this program, Hazel Henderson continues discussing with Professor Jon L. Mills his current book, Privacy in the New Media Age. The conversation focuses on the USA and how the Constitution favors free speech and press in the First Amendment over individual rights to privacy. Mills cites many examples of how individuals are harmed in today’s social media, by false statements by bloggers, ubiquitous cameras in public places, tracking individuals’ movements via their cellphones and GPS. They explore data-collecting by government and by corporations selling users’ personal data to advertisers, as well as snooping by drones. Again, these new technologies and media have outrun the law and public awareness and in some cases even dubious rulings by the Supreme Court.

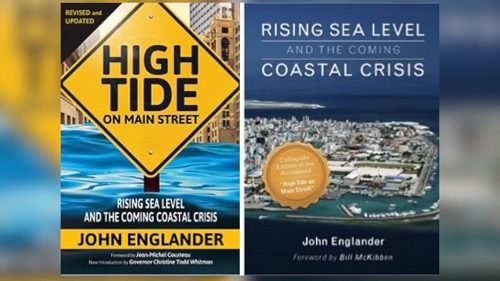

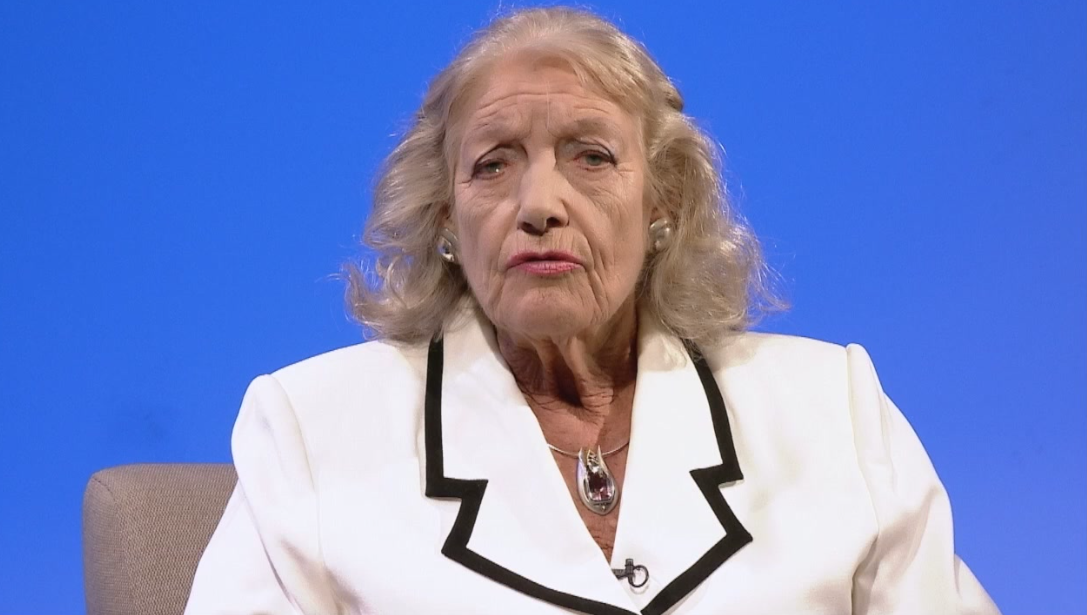

Rising Sea Levels Worldwide Part 1 – John Englander 796

In this program Hazel Henderson discusses with John Englander, geologist and oceans expert, author of Rising Tide on Main Street, the steady rise of global oceans due to global atmospheric levels of carbon dioxide and other greenhouse gases. The Earth’s temperature continues rising as fossil fuels are burned, oceans absorb additional CO2, glaciers and ice sheets at the planet’s poles are melting. Englander studies coastlines and show visual evidence of the effects on the World’s 20 most vulnerable cities: Boston, New York, Washington DC, Seattle, San Diego, as well as Shanghai, London, Bangkok and low-lying countries Holland, the Philippines and many small island sates. In some areas, land is also sinking, and in others tectonic plates cause the land under, for example Los Angeles, to rise. Since 2015, 195 countries have agreed to address these largely human-caused effects with transition management strategies: investments in adaptation, sea walls, more and higher levees, relocation of humans settlements and shifting to renewable energy. Timeframes for action are reviewed. Transition management begins with realistic views of global change. Ethical Markets Transforming Finance Series, @2015

Rising Sea Levels Worldwide Part 2 – John Englander 797

In this program, Hazel Henderson discusses with John Englander, geologist and oceans expert, author of Rising Tide on Main Street, all the sensible, realistic ways that humans can practice transition management: by mitigating and adapting to rising sea levels. The world’s oceans will continue their steady rise – even if fossil fuel burning were to cease immediately. The long-term processes set in motion by rising global temperatures, melting glaciers and polar ice sheets are altering risk-analyses models in finance, insurance and business. Transition management strategies and options are discussed, from changing real estate values; building codes; reinforcing urban infrastructure; siting of essential transport and communications networks, as well as how investments will be affected and where new opportunities lie in shifting beyond fossil fuels to low-carbon, cleaner green economies. Ethical Markets Transforming Finance Series, @2015

Common Good Capitalism – Terry Mollner 798

In this program, Hazel Henderson discusses transition management strategies and the likely next stage of capitalism with Terry Mollner, author of Common Good Capitalism: It’s Next! and board member of Ben and Jerry’s ice cream, now owned by global food giant Unilever. Terry describes the saga of this negotiation with Ben and Jerry’s shareholders, their effort to remain independent and how their social mission was recognized and began to change Unilever. Terry points to the current wave of mega-mergers in our global economy, where brands in food, air travel, communications and many other sectors end up cooperating as duopolies. In this world beyond competition companies can reach a new level: changing their goals and business models so as to place top priority on cooperatively serving the common good with competitive profit-seeking taking second place. How to square this with anti-trust conventions will be key. These startling views will be hotly debated as human populations and economies learn transition management strategies as tools to develop further on our small finite planet. Ethical Markets Transforming Finance Series, @2015

Competition, Creativity and Cooperation – Terry Mollner 799

In this program, Hazel Henderson with Terry Mollner, author of Common Good Capitalism: It’s Next! examine his hopeful view of transition management. Mollner explains how capitalism can evolve from today’s global completion for resources and markets and the toll this takes on our societies and planetary ecosystems. Competition and human creativity have brought us to this stage. Both agree on today’s wider perception, scientific discoveries, new communications tools, satellites observing our effects on the Earth which make it evident that cooperation must now be the framework for all our actions. This is in line with Charles Darwin’s view that humanity’s success in evolving for millennia is based on our genius for cooperating. Nature’s transition management is driven by adaptation to environmental stresses. Darwin’s conviction saw our further development would lead to more altruism as we recognize our inter-dependence on each other and all lifeforms on our planetary home. Ethical Markets Transforming Finance Series, @2015

Global system Change Part 1 – Frank Dixon 800

In this program, Hazel Henderson discusses a range of global challenges and transition management strategies with Frank Dixon (Harvard MBA), former head of global research with the famed, pioneering social auditing firm Innovest. They discuss the ways in which global geopolitics is evolving in response to the systemic changes to our planet’s ecosystems due to human activities. As water shortages, drought, floods and climate disruption effect more countries and populations, decision-makers in business government and civic society are seeing that all these problems are inter-linked. Frank Dixon’s book, Global System Change, maps these global issues and connects the dots. At the same time, Henderson points to the same new awareness by over 190 member countries of the United Nations in their 2015 agreement on the 17 issues addressed in their Sustainable Development Goals (SDGs). There is now evidence that humans are accepting responsibility for the changes created by unsustainable industrial development and moving toward integrated policies. These realistic approaches to transition management can lead to cleaner, healthier, more equitable societies on which our survival may depend. Ethical Markets Transforming Finance Series, @2015

Achieving Global Sustainability and Real Prosperity Part 2 – Frank Dixon 801

In this program, Hazel Henderson discusses with Frank Dixon, MBA, author of Global System Change, the massive transition now underway to innovate and build societies powered by renewable energy and resources. All are based on more cooperative sharing models. This transition management is driven by new paradigms beyond traditional economics which are multi-disciplinary. They are based on new understanding of human behavior and the integrated science of Earth systems with information from 120 orbiting observation satellites. They discuss how all this new knowledge is seeping into financial models and steering investments in more sustainable production and ways of organizing human settlements and regenerating ecosystems. All these new transition management methods require redefining growth and prosperity and reshaping our political systems, mass media and lifestyles. These changes ae underway at every level from individuals and communities to nations, corporations and international organizations. Ethical Markets Transforming Finance Series, @2015

Beyond Blood Stained Gems: New Science & Standards – Frank Dixon 802

In this program, Hazel Henderson explores with Frank Dixon, MBA, author of Global System Change, the damaging effects of the global gem mining industry, now a case study in transition management. This industry has been the focus of many NGO critics since diamond mining is not only dangerous and polluting, but has helped fuel armed conflicts in many African countries. Several UN resolutions have addressed the need to stop the flow of these “blood diamonds” and the global diamond cartel has responded with the Kimberley Certification which only certifies their diamonds are “conflict-free”. This ignores the much larger problems of miners’ injuries, deaths, low wages and the pollution of water supplies and air in mining areas and communities. Beyond these hazards is the fact that this gem mining industry is now obsolete and unnecessary, since science now produces identical gems in laboratories in many countries without human and environmental damage. Thus Dixon examines Ethical Markets transition management tool: its global standard, EthicMark® GEMS which certifies only gems not mined from the Earth. Dixon asks Henderson how this better standard was developed and how it can challenge this obsolete mining industry by this market-based transition to reform: EthicMark® GEMS can create a healthier new industry and many thousands of new jobs while saving lives, human misery and the environment – an illustration of positive transition management. Ethical Markets Transforming Finance Series, @2015

Evolution of Corporate Responsibility and Accountability – Marcello Palazzi 803

In this program, Hazel Henderson discusses with Marcello Palazzi, MBA, president of the Progressio Foundation in Holland, their experiences in developing these new standards for transition management: corporate social performance and auditing over the past 30 years. Palazzi recounts his path in business and how he came to realize that standards for environmental, social responsibility were rising as the effects of corporate activities disrupted communities and ecosystems. Henderson’s experiences came from a civic organization she co-founded, Citizens for Clean Air, in the USA and how this led to her lifelong work as a science policy advisor in Washington and with the Calvert Social Investment Fund. Both had focused on aspects of transition management, developing new accounting models and metrics. These are now globally accepted by such organizations as the International Integrated Reporting Council (IIRC), the Global Reporting Initiative (GRI) and the Sustainable Accounting Standards Board (SASB). Ethical Markets Transforming Finance Series, @2015

Rise of the Benefit Corporation – Marcello Palazzi 804

In this program, Hazel Henderson discusses with Marcello Palazzi, MBA, president of the Progressio Foundation in Holland, his latest work in transition management by promoting the new business charter: the Benefit Corporation, which certifies companies which focus beyond profitability to service and benefit society. This new model is now legally chartered in 30 states in the USA, also in Latin America and Europe. The founders of Certified B Corporations Jay Coen Gilbert, Andrew Kassoy and Bart Houlahan recently were awarded a coveted prized by the Aspen Institute. Palazzi and Henderson explore examples of B Corporations, which include Ethical Markets Media. This new socially responsible business model is enjoying rapid growth and includes several publicly traded corporations. These examples are further case studies in positive transition management. Ethical Markets Transforming Finance Series, @2015

Trends Toward Sustainability in Brazil – Thais Corral 805

In this program, Hazel Henderson discusses with award-winning civic leader Thais Corral, co-author of Leadership Is Global, the current crises and transitions occurring in her country Brazil. Brazil has all the resources and capital assets it needs to make the transition to sustainability, including human, social and intellectual capital with advanced infrastructure and industries, and the planet’s primary storehouse of natural capital. However, Brazil’s active democracy needs to shake off the obsolete fossil-fueled industrial model still imposed by foreign investors and traditional financial models. Thais Corral points to Brazil’s rich civic society traditions, participatory politics, its optimistic people and their open flexibility in embracing change as their best resource in transition management. This civic genius is the “software” that may prove to be Brazil’s unique export to the world and its struggle for domestic reforms offer lessons for other countries. Ethical Markets Transforming Finance Series, @2015

The Personal Journey of Brazilian Leader Thais Corral 806

In this program, Hazel Henderson explores with award-winning civic leader, recognized in Brazil by the UN, Thais Corral, co-author of Leadership Is Global, her personal story. Thais and her family came to Brazil from Spain, bringing their entrepreneurial skills and creativity. Thais, a lifelong learner, spent years studying in Italy, other European countries, and the USA at the University of Chicago and Harvard. She innovated 400 radio programs broadcasted to empower women across Brazil and became a co-founder of the global Women’s Environment Development Organization (WEDO) with US Congresswoman Bella Abzug. Thais then founded the learning and leadership programs at Sinal do Vale, a large estate 30 minutes from Rio De Janeiro’s mains airport, where participants learn all the tools of transition management first hand. Ethical Markets is partnering with Thais in this new educational program since Thais is a member of our global Advisory Board. Ethical Markets Transforming Finance Series, @2015

The Evolution of Sustainability Accounting – Alice Tepper Marlin 807

In this program, Hazel Henderson interviews her longtime associate Alice Tepper-Marlin, president-emeritus of SAI International and key founder of the pioneering transition management example: the socially responsible investment movement. They reminisce on the evolution of this form of accounting which screened portfolios and companies for their ethical, social and environmental performance. Tepper-Marlin founded the pioneer group, the Council on Economic Priorities (CFP) in the 1960s and Henderson became a board member, along with famed economist Robert Heilbroner, author of The Worldly Philosophers (1999). Tepper-Marlin recounts the first study by CEP of pollution in 24 pulp and paper companies and how the companies stalled at first but eventually provided data. CEP’s consumer guide, Shopping for a Better World, sold over 1 million copies and catapulted CEP into creating this new branch of accounting and securities analysis – and Tepper-Marlin into widespread media recognition. Another successful model of positive transition management! Ethical Markets Transforming Finance Series, @2015

13. The Future: Toward Full-Spectrum Accounting – Alice Tepper Marlin 808

In this program, Hazel Henderson discusses with Alice Tepper-Marlin, president-emeritus of SAI International and founder of 10-Squared, the future of accounting for ethical, social and environmental performance of portfolios, companies and governments. This important tool of transition management is full-spectrum accounting, a multi-disciplinary method. This goes beyond the earlier money-based models evaluating life-cycle costs and recognizing 6 kinds of capital: financial, built facilities, intellectual, social, human and natural capital. These broader metrics are now promulgated globally by the International Integrated Reporting Council (IIRC) and the Global Reporting Initiative (GRI) and in the USA by Sustainable Accounting Standards Board (SASB), chaired by Michael Bloomberg. At last, the obsolete models in traditional economics permitting social and environmental costs to be “externalized” is exposed as irresponsible. Tepper-Marlin describes her latest venture 10-Squared, another transition management innovation and management tool for companies to achieve better social and environmental performance goals. Ethical Markets Transforming Finance Series, @2015

809- Responsible Investors Transforming Finance

Hazel Henderson discusses the evolution of the ethical, responsible, green investment movement with British pioneer investor Tessa Tennant. Tennant founded the first green UK mutual fund as well as the Social Investment Forum. She reviews the early obstacles, as she founded ASRIA, the first such group in Asia. An inspiring personal story! © 2016 Ethical Markets

Responsible Investors

810 – The Future of Finance: Sustainability or Collapse?

Hazel Henderson and UK investment pioneer Tessa Tennant look at the new consensus emerging in 2015 for the global transition from fossil fuels to clean, green, sustainable economies. Tennant serves on the British Green Investment Bank. Now that 195 countries have signed on to the United Nations Sustainable Development Goals (SDGs) and the COP21 Climate Accords, this transition is accelerating worldwide. © 2016 Ethical Markets

821 – Empowering Our Personal and Professional Journeys

In this program Hazel Henderson explores with Dr. Monica Sharma, author of Radical Transformational Leadership (2018) her personal story growing up in India. How she practiced medicine there and grew to understand the importance for human health of looking at her patients’ life circumstances and their environments. Dr. Sharma became a leader in many United Nations health initiatives and her leadership style can inspire and empower many others.

823 – “Your Money or Your Life”

“Your Money Or Your Life”

with author Vicki Robin

In this program Hazel Henderson discusses with author Vicki Robin how the financial markets have changed since her book “Your Money or Your Life”, originally co-authored with Joe Dominguez, was first published in 1993. This perennial best-seller was updated again by Vicki Robin in 2018 and found a new audience of half a million millennial followers. Vicki describes how investing has changed to focus more locally and personal growth an achievements. Vick’s new fame includes interviews in the Wall Street Journal, The New York Times and the cover of Money Magazine.

Show #1— “Taming the Global Casino”

Ben Bingham, 3 Sisters Sustainable Management, LLC

Downsizing and reforming global capital markets with pioneer asset manager Benjamin Bingham on financial transactions tax to curb excessive speculation and high-frequency trading, closing tax havens, raising capital reserves, breaking up too-big-to-fail banks and more. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

“Greening The Global Food System”

“Blessing the Hands That Feed Us”

with author Vicki Robin

In this program Hazel Henderson discusses with author Vicki Robin the unsustainable global food system and reforms needed, described in her book “Blessing the Hands That Feed Us”. Vicki describes how locally-grown organic foods are a growing segment worldwide and offer better nutrition as well as more secure livelihoods for farmers. Opportunities are discussed on all the ways our unsustainable global agro-chemical industrial complex with its narrow mono-culture crops in global trade are feeding perilously on the planet’s 3% of freshwater. Meanwhile all the hundreds of salt tolerant food plants that grow in 22 countries on desert lands can be added, along with many other overlooked native plants, as well as all the startups in plant-protein foods offering better nutrition for the growing vegetarian consumer markets.

Show #2—“Bypassing Wall Street”

Katherine Collins, Honeybee Capital

Holding stock-markets to higher ethical standards, regulation and oversight for accountability. Why successful asset manager Katherine Collins sought a more ethically satisfying life beyond Wall Street after her degree at Harvard Divinity School. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

825 “Reintegrating, Finance, Sustainability, and the Quality of Life” with Paul Ellis, Principal, Paul Ellis Consulting and Podcasts

In this program Hazel Henderson discusses with Paul Ellis, veteran financial adviser and consultant, how his practice evolved into broader concerns for our common future. Paul had discovered the Calvert-Henderson Quality of Life Indicators (2000) which Hazel and the Calvert group developed. Later, in 2015 Paul found the United Nation’s Sustainable Development Goals (SDGs). Paul and Hazel had never meet until this show. They discuss how their mutual goals became aligned in their respective efforts to reform mainstream finance and its narrow focus on obsolete economics and short-term profits. Now both work in a new partnership to promote the SDGs!

Show #3—“Daring to Care—Prosperously!”

Susan Davis, Capital Missions Company

Legendary banker Susan Davis describes her winning philosophy, KINS, based on strategies of generosity, win-win deals, connecting investors around conscious capitalism and growing fairer, greener economies worldwide as described in her autobiography, The Trojan Horse of Love. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

826 -“Steering Our Societies from GDP to SDGs” with financial advisor and podcaster Paul Ellis of Paul Ellis Consulting

In this program, Hazel Henderson and Paul Ellis discuss their respective and complementary work in reforming mainstream finance and economic textbooks. They share how these obsolete models and metrics had been steering societies toward greater environmental despoliation and unanticipated social problems.

Money-based Gross Domestic Product (GDP) was never intended to be a measure of human progress, while over averaged macroeconomic indicators of inflation, unemployment, savings, etc. were like flying over a country at 50,000 feet! Both Hazel and Paul rejoiced in 2015 when 195 member countries of the United Nations launched their Sustainable Development goals (SDGs). At last, these 17 Goals, ratified by all sectors, systemically based in metrics of empirical sciences, can now steer the world’s countries away from the cliff edge toward knowledge-richer, inclusive sustainable societies for our common human future.

Show #4—“The Future of Socially Responsible Investing”

Amy Domini, Domini Social Investments

Industry icon Amy Domini, author of the landmark book Socially Responsible Investing, Making a Difference and Making Money. Amy created the Domini Social 400 Index which regularly outperforms conventional benchmarks and founded Domini Social Investments. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Show #5— “Transition to a Global Green Economy”

Alisa Gravitz, President, Green America

Alisa Gravitz took her Harvard MBA into uncharted waters in co-founding Green America and the National Green Pages. Her latest innovation is CREW, a business-to-business barter site. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Show #6— “Should Banks Be Public Utilities?

Leland Lehrman, Fund Balance, LLC

Leland Lerhman, principal, Fund Balance, is an investor with deep ecological understanding and visionary proposals for correcting the failing financial models. These derived from obsolete economics now harming both humans and our planet. Leland and Hazel are both advisors to the Public Banking Institute founded by lawyer Ellen Brown, author of The Web of Debt. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Show #7— “The Politics of Money”

Christopher Lindstrom, Slow Money

Christopher Lindstrom and Hazel discuss their longtime, often shared efforts to reform the money-creation process. They both promote the many local, complementary currencies now in circulation in hundreds of cities around the world. Chris was a key actor in launching “Berkshares,” the successful currency of the Schumacher Society developed by Susan Witt in Great Barrington, Massachusetts. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Show #8— “Cooperation Beats Competition”

Terry Mollner, Trusteeship Institute, Inc.

Terry Mollner, a leader in co-founding the Calvert Group of socially responsible mutual funds also spent time in India following the exemplary life of Mahatma Gandhi. He also serves on the board of Ben and Jerry’s Ice Cream, now owned by Unilever. Terry got this giant multinational to sign a path breaking agreement to preserve Ben and Jerry’s social mission. Terry and Hazel agree that the next stage of finance is full recognition of the primacy of the global commons and hence placing the common good above all else if we are to preserve our common future. “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

Show #9— “Reforming Housing, Fannie and Freddie”

Sarah Stranahan, New Economy Network

Longtime community-development specialist, housing expert and investor Sarah Stranahan tells Hazel how the struggling US housing market can be revived by adopting viable policies pioneered during the New Deal. Millions of homeowners were saved from foreclosure then, and the US Treasury can do the same by following these policies and revitalizing Fannie and Freddie – owned by US taxpayers already! “Transforming Finance 2.0” – an Ethical Markets Media, LLC, production © 2012

395

Building the Woman’s World Banking Movement – interview with Michaela Walsh; Ethical Markets Transforming Finance Series 2013. Michaela Walsh is Founding President of Women’s World Bank http://www.swwb.org/, expanding economic assets, participation and power of low-income women and their households by helping them access financial services, knowledge and markets. She discusses transforming finance through women’s banking with Hazel Henderson.

396

Banking for the Common Good – interview with Mary Houghton, Ethical Markets Transforming Finance Series 2013. Mary Houghton is the co-founder of ShoreBank, once the largest and oldest community development bank in the US. She shares her transforming finance views on community banking with Hazel Henderson.

397

The Green Economy — A Wide Shot – interview with Gregory Wendt; Ethical Markets Transforming Finance Series 2013. This is a wide-ranging discussion of the green movement today and transforming finance with Hazel Henderson.

0023

Getting From Here To There – Reviews what can be done today to forge new paths to human development and ecological sustainability. (~ 27 minutes). From Ethical Markets miniseries on International Financial Reform, featuring John Perkins, Kenneth Rogoff and Sakiko Fukudu-Parr.

0022

Visions For A Better Future – Discusses the many researchers and think tanks offering alternative paths to more just and humane forms of development.(~ 27 minutes) . From Ethical Markets miniseries on International Financial Reform, featuring John Perkins, Kenneth Rogoff and Sakiko Fukudu-Parr.

0021

Reforming The IMF – The IMF is in crisis – few countries want its loans and the onerous restrictions and “conditionalities” imposed. The future of the IMF will require massive reform. (~ 27 minutes) . From Ethical Markets miniseries on International Financial Reform, featuring John Perkins, Kenneth Rogoff and Sakiko Fukudu-Parr.

0020

Reforming The World Bank – Examines the structure and workings of the World Bank and why it is under attack from all quarters. Reforms and proposed actions. (~ 27 minutes) . From Ethical Markets miniseries on International Financial Reform, featuring John Perkins, Kenneth Rogoff and Sakiko Fukudu-Parr.

0019

Why Reform Global Finance? – Financial crises, booms, busts and bubbles signal the need to overhaul the global financial system. What kind of reforms can re-direct economic development toward equity and sustainability? (~ 27 minutes) . From Ethical Markets miniseries on International Financial Reform, featuring John Perkins, Kenneth Rogoff and Sakiko Fukudu-Parr.

REFORMING THE ECONOMY – These and dozens more videos picked by Hazel Henderson and the Ethical Markets team which explore how the US and global economy have faltered and offering creative solutions moving forward.

0005

Provided by www.MoneyAsDebt.net Money as Debt – This is a must see video that sparks great conversations in any group who views it.

Provided by www.MoneyAsDebt.net Money as Debt – This is a must see video that sparks great conversations in any group who views it.

Debt-gov’t, corporate, & household has reached astronomical proportions. Where does all this money come from? How could there BE that much money to lend? The answer is… there isn’t. Today, MONEY IS DEBT. If there were NO DEBT there would be NO MONEY! If this is puzzling to you, you are not alone. Very few people understand, even though all of us are effected. This fast-paced and highly entertaining animated feature explans today’s magical perverse DEBT-MONEY SYSTEM (~ 47 minutes)

0360

The Story of Citizens United v. FEC — provided by StoryofStuff.org; Annie Leonard brings her unique insight to the world of corporate influence on American politics.

0333

The Money Fix — provided by Ethical Markets; on PBS stations and affiliates around the US for free download from www.epstv.com. Directed and produced by Alan Rosenblith (see full version at www.themoneyfix.org) and edited for TV by Hazel Henderson, this feature-length documentary explores our society’s relationship with the almighty dollar and examines economic patterning in both the human and the natural worlds. Most of us take the monetary system for granted, but it has a profound and largely misunderstood influence on our lives. The film documents alternative money systems which help solve economic problems for the communities in which they operate.

0068

The Money Fix – Provided by The Money Fix, Hazel Henderson discusses the current ineffective methods of measuring true wealth and the inappropriate use of money, giving examples like the false Nobel Prize in Economics. (~ 9 minutes)

0100

Green Transition Scoreboard(r) Explained – scripted and narrated by Hazel

Henderson, Ethical Markets Media (c) 2014

0287

Re-Inventing Money provided by Zeitfilm.de; Dr. Margrit Kennedy makes the case for complementary currencies.

0288

Money for the Future provided by Zeitfilm.de; Bernard Lietaer offers systemic solutions for the financial crises.

0358

Berkshares — provided by WCBV TV Boston; BerkShares board member, Will Conklin, describes how when money is spent at local stores the multiplier effect on the local economy is much deeper and wider than money spent at chains or on the internet. The film visits Berkshire Bank and Tom’s Toys to explore the topic.

Money Innovation Explores varied money systems such as complementary currencies and local currencies

0237

Coming Home: E.F. Schumacher and the Reinvention of the Local Economy” provided by Chris Bedford Films and the Schumacher Society; Sincere appreciation goes to Chris Bedford who made this film as a labor of love, telling the story of rebuilding a local economy using strategies from community land trusts to the nation’s most successful local currency – Berkshares. Copies of the film can be obtained at www.localharvest.org.

0245

The Organic Opportunity provided by Chris Bedford Films; Chris Bedford tells the story of Woodbury County, Iowa, first in the US to promote local organic agriculture as economic development by offering tax rebates to farmers transitioning to organic agriculture, mandating purchase of locally grown organic food by county institutions and offering no-cost loans and free building lots to farmers relocating to the county to farm organically. Copies of the film can be obtained at www.localharvest.org.

0333

The Money Fix — provided by Ethical Markets; on PBS stations and affiliates around the US for free download from www.epstv.com. Directed and produced by Alan Rosenblith (see full version at www.themoneyfix.org) and edited for TV by Hazel Henderson, this feature-length documentary explores our society’s relationship with the almighty dollar and examines economic patterning in both the human and the natural worlds. Most of us take the monetary system for granted, but it has a profound and largely misunderstood influence on our lives. The film documents alternative money systems which help solve economic problems for the communities in which they operate.

RETHINKING GLOBALIZATION a series produced by Hazel Henderson with guests Dee Hock, Oscar Motomura and Don Beck

0207

World Trade & Finance with Dee Hock and Oscar Motomura, from the series Rethinking Globalization with Hazel Henderson, provided by Ethical Markets Media and Florida Community College at Jacksonville.

0208

The Link Between Human Rights and Responsibilities with Dr. Don Beck, from the series Rethinking Globalization with Hazel Henderson, provided by Ethical Markets Media and Florida Community College at Jacksonville.

0262

Navajo Green provided by LivingOnEarth; shows effort and enthusiasm to bring green jobs to Navajo communities by adopting green job legislation, complimenting a way of life valued by many indigenous peoples.

0266

Ellen Brown – Financial meltdown: Why it happened, How it can be reversed provided by Democracy for America; Ellen Brown, author of Web of Debt, explains the roots of the current economic crisis and a way out. Brown’s articles are regularly posted at www.ethicalmarkets.com. Her presentation begins about 11 1/2 minutes into the video. Worth the wait!

0290

Move Your Money provided by MoveYourMoney.info; introduces the compelling movement to move individual bank accounts from the “too big to fail” institutions into community banks and credit unions

0224

BerkShares Local Currency on BBC provided by the E.F. Schumacher Society and the BBC; BerkShares local currency supports the community, economy, ecology, and sustainability of the southern Berkshire region of Massachusetts. Launched by the E. F. Schumacher Society, BerkShares create consumer awareness about the consequences of spending practices, supports local businesses, facilitates the development of import replacing industries, and serves as a model for other regions.

0237

Coming Home: E.F. Schumacher and the Reinvention of the Local Economy” provided by Chris Bedford Films and the Schumacher Society; Sincere appreciation goes to Chris Bedford who made this film as a labor of love, telling the story of rebuilding a local economy using strategies from community land trusts to the nation’s most successful local currency – Berkshares. Copies of the film can be obtained at www.localharvest.org.

0245

The Organic Opportunity provided by Chris Bedford Films; Chris Bedford tells the story of Woodbury County, Iowa, first in the US to promote local organic agriculture as economic development by offering tax rebates to farmers transitioning to organic agriculture, mandating purchase of locally grown organic food by county institutions and offering no-cost loans and free building lots to farmers relocating to the county to farm organically. Copies of the film can be obtained at www.localharvest.org.

COMMUNITY DEVELOPMENT SOLUTIONS – With the collapse of global financial norms, these videos demonstrate the creative ways in which communities are facing the challenges of producing and consuming sustainably.

0385

Bank of North Dakota – provided by Prairie Public Television and the Public Banking Institute; During the early 1900s, North Dakota was dependent on agriculture. To diversify the economy, North Dakota created the state-owned Bank of North Dakota, largely credited for making North Dakota the only state with a large budget surplus. This film discusses the bank’s history and plans for the future.

Creating Alternative Futures – A 13-part series of fast-paced conversations featuring speakers such as Alvin Toffler, John Naisbitt, Fritjo Capra, Jean Houston and Oscar Motomura aired on PBS stations, all moderated by Hazel Henderson.

Creating Alternative Futures – A 13-part series of fast-paced conversations featuring speakers such as Alvin Toffler, John Naisbitt, Fritjo Capra, Jean Houston and Oscar Motomura aired on PBS stations, all moderated by Hazel Henderson.

Worth Quoting TV seriesCommentaries and dialogues, many with Hazel Henderson, which stand the test of time, including a rare interview with Aurelio Peccei, late founder of the Club of Rome; also Barbara Marx Hubbard, Fritjof Capra, Frank Bracho, James Robertson, Frederick Hayek and others.

Worth Quoting TV seriesCommentaries and dialogues, many with Hazel Henderson, which stand the test of time, including a rare interview with Aurelio Peccei, late founder of the Club of Rome; also Barbara Marx Hubbard, Fritjof Capra, Frank Bracho, James Robertson, Frederick Hayek and others.

Comedy – Shows and videos which allow us to laugh as we learn

Comedy – Shows and videos which allow us to laugh as we learn

0277

Piano Player Stairs provided by Thefuntheory.com; To save energy, to improve health, to promote our innate creativity, something as simple as fun is the easiest way to change people’s behaviour for the better.

0329

“What Would the Founding Fathers Do? — provided by FairElectionsNow.org; In 1776 the Founding Fathers threw off the yoke of British tyranny. Now they’re back to throw off the yoke of British Petroleum — and the other peddlers of influence who have befouled our fair democracy by pushing Congress to pass the Fair Elections Now Act. Learn more at FairElectionsNow.org.

0039

Minds for History – A conference in May, 1989, discussing humanity’s future with Nobelists Murray Gell-Mann and Czeslaw Milosz, Richard Falk, Harvey Cox, Hazel Henderson and jazz musician Billy Taylor.

Classic Talk – Commentaries and dialogues, many with Hazel Henderson, which stand the test of time, including a rare interview with Aurelio Peccei, late founder of the Club of Rome; also Barbara Marx Hubbard, Fritjof Capra, Frank Bracho, James Robertson, Frederick Hayek and others.

Classic Talk – Commentaries and dialogues, many with Hazel Henderson, which stand the test of time, including a rare interview with Aurelio Peccei, late founder of the Club of Rome; also Barbara Marx Hubbard, Fritjof Capra, Frank Bracho, James Robertson, Frederick Hayek and others.

0066

Strategies for Sustainable Economies – Hazel

Henderson in conversation with James Robertson, British author of

Power, Money and Sex and The Future of Work, about globalization,

out-sourcing, automation and new forms of development.

0065

Redefining Cultural Values – Hazel

Henderson and Frank Bracho, former Venezuelan Ambassador to India,

author of Globalization and Petroleum: Salvation or Perdition, discuss

the importance of culture in development.

0064

Ecoliteracy and System Thinking – Hazel Henderson and Fritjof Capra, author of The Web of Life, examine the educational movement to teach “ecoliteracy,” an understanding of ecosystems as humanity’s life-support system, and how this leads to systems thinking.

0063

Empowering Women’s Visions – Hazel Henderson and Barbara Marx Hubbard, author of The Hunger of Eve, discuss women as visionary leaders and why they are important for our changing world.

0062

Seven Steps to a New Millennium – Hazel Henderson and Barbara Marx Hubbard, author of Human Social Potential, discuss possibilities for humans as we extend our space program.

- Classic Talk

- Comedy

- Money Innovation

- Community Development Solutions

- Creating Alternative Futures

- Dialogues with Hazel Henderson

- Ethical Markets(SM)

- GLOBAL CITIZENS : CREATIVE SOLUTIONS

- Insights from The Green

- International Financial Reform

- Mercado Ético – Ethical Markets in Brazil

- Reforming Global Finance

- REFORMING THE ECONOMY – picked by Hazel Henderson and the Ethical Markets team

- Rethinking Globalization

- Social Entreprenuer

- The Power Of Yin

- Worth Quoting TV series

- Green Energy and Technologies

0071

Urmee Mehta Mankar – Swadhaar – Micro Finance – Provided by the Skoll Foundation and Social Edge

0388

Austerity and the Destruction of Democracy – provided by theRealNews.com; Rob Johnson: Austerity policies in Europe threaten a deformation of democracy and the rise of ultra-nationalist forces

336

The Consequence of Oil Part 1 — provided by Global Access Media; The Consequence of Oil investigates the cover up of the massive amount of oil and chemical dispersants that are still in the ocean and marshes, the possibly illegal and toxic use of the dispersant Corexit in coastal population zones, and the continued effects of the BP oil spill on the Gulf environment, residents, and clean up crews.

0146

Credit Crunch-Provided by Bremner, Bird and Fortune, Vera Productions; John Bird and John Fortune brilliantly and accurately describe the mindset behind the credit crunch with this satirical interview of George Parr. {@7 min}

Credit Crunch-Provided by Bremner, Bird and Fortune, Vera Productions; John Bird and John Fortune brilliantly and accurately describe the mindset behind the credit crunch with this satirical interview of George Parr. {@7 min}

0252

Turning the Tide, a project of the Institute at the Golden Gate – highlight

video of the 2009 conference.

0023

Getting From Here To There – Reviews what can be done today to forge new paths to human development and ecological sustainability. (~ 27 minutes). From Ethical Markets miniseries on International Financial Reform, featuring John Perkins, Kenneth Rogoff and Sakiko Fukudu-Parr.

398 – Promo – “Green Banking and Investing”

Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 2013

399 – Promo -“Nurturing Sustainable Local Communities Worldwide”

“Nurturing Sustainable Local Communities Worldwide” – Interview with Steven Lovink – Founder/CEO, Planet2025 Network and Power of One; Ethical Markets Transforming Finance Series 2013

400 – Promo – “Permaculture, Eco-forests Developing Green Economies”

“Permaculture, Eco-forests Developing Green Economies”

Terry Mock – Co-founder, Champion Tree Project International and the Sustainable Land Development Initiative; Ethical Markets Transforming Finance Series 2013

401 – Promo – “Financing the Green Transition to the Coming Solar Age”

“Financing the Green Transition to the Coming Solar Age”

Peter Lynch – Private Investor and Financial/Technology Advisor to Investors; former senior editor, Photovoltaic Insider Report; Ethical Markets Transforming Finance Series 2013

402 – Promo – “Healthy Foods, Healthy Lifestyles: Paths to Happiness”

“Healthy Foods, Healthy Lifestyles: Paths to Happiness”

Martin Ping – Executive Director, Hawthorne Valley Association, Ethical Markets Transforming Finance Series 2013

403 – Promo – “Strengthening Locally Owned Independent Finance”

“Strengthening Locally Owned Independent Finance”

David Rose – Founder and CEO, Unified Field Corporation; Creator, Unified Field Bank™, Ethical Markets Transforming Finance Series 2013

404 – Promo – “Fostering Homegrown Reliable Economies”

“Fostering Homegrown Reliable Economies”

Stuart Valentine – Principal, Centerpoint Investment Strategies, Ethical Markets Transforming Finance Series 2013

0343

Financing Clean Development – interview with Graciela Chichilnisky, “Transforming Finance” — an Ethical Markets Media production © 2010

0344

Private Financing of Green Companies – interview with Karl Kleissner, “Transforming Finance” — an Ethical Markets Media production © 2010

409 – “Daring to Care: Growing the Love Economy” – Interview with Louis Böhtlingk

“Daring to Care: Growing the Love Economy” – Interview with Louis Böhtlingk – Founder, Care First World; author, Dare to Care; Ethical Markets Transforming Finance Series 2013

410 – “Recognizing the Power and Purpose of Non-profits” – Interview with Linda Crompton

“Recognizing the Power and Purpose of Non-profits” – Interview with Linda Crompton – Principal, Crompton Consulting, LLC; former president of BoardSource (the national center for non-profit boards); Ethical Markets Transforming Finance Series 2013

0345

Greening of Pension Funds interview with Bryan Martel, “Transforming Finance” — an Ethical Markets Media production © 2010

0347

Steering Capital Toward Sustainability interview with John Fullerton, “Transforming Finance” — an Ethical Markets Media production © 2010

0348

Finance is a Global Commons interview with Leo Burke, “Transforming Finance” — an Ethical Markets Media production © 2010

0349

Escaping the Web of Debt – interview with Ellen Brown, “Transforming Finance” — an Ethical Markets Media production © 2010

413 – “Healthy Foods, Healthy Lifestyles- Paths to Happiness” – Martin Ping

“Healthy Foods, Healthy Lifestyles: Paths to Happiness”

Martin Ping – Executive Director, Hawthorne Valley Association, Ethical Markets Transforming Finance Series 2013

0350

Finance Should Serve Society – interview with Steve Waddell, “Transforming Finance” — an Ethical Markets Media production © 2010

414 – ““Financing the Green Transition to the Coming Solar Age” – Peter Lynch

“Financing the Green Transition to the Coming Solar Age”

Peter Lynch – Private Investor and Financial/Technology Advisor to Investors; former senior editor, Photovoltaic Insider Report; Ethical Markets Transforming Finance Series 2013

0351

China’s New Development – interview with Zhouying Jin, “Transforming Finance” — an Ethical Markets Media production © 2010

415 – “Nurturing Sustainable Local Communities Worldwide” – Interview with Steven Lovink

“Nurturing Sustainable Local Communities Worldwide” – Interview with Steven Lovink – Founder/CEO, Planet2025 Network and Power of One; Ethical Markets Transforming Finance Series 2013

416 – “Fostering Homegrown Reliable Economies” – Stuart Valentine

“Fostering Homegrown Reliable Economies”

Stuart Valentine – Principal, Centerpoint Investment Strategies, Ethical Markets Transforming Finance Series 2013

417 – “Permaculture, Eco-forests Developing Green Economies” – Terry Mock

“Permaculture, Eco-forests Developing Green Economies”

Terry Mock – Co-founder, Champion Tree Project International and the Sustainable Land Development Initiative; Ethical Markets Transforming Finance Series 2013

418 – Promo – “Green Banking and Investing” – Interview with Ken La Roe

“Green Banking and Investing” – Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 2013

419 – “Green Banking and Investing” – Interview with Ken La Roe

“Green Banking and Investing” – Interview with Ken La Roe – Founder, CEO and Chairman, First Green Bank, Florida; Ethical Markets Transforming Finance Series 201

425 – Beyond Economics to Earth Systems Science – Interview with Michael Grunwald

“Beyond Economics to Earth Systems Science” – Interview with Michael Grunwald – TIME, Time.com, Senior National Correspondent; author, The New New Deal (2012); Ethical Markets Transforming Finance Series 2013

420 – Transition to the Green Economy – Michael Grunwald

“Transition to the Green Economy” – Interview with Michael Grunwald – TIME, Time.com, Senior National Correspondent; author, The New New Deal (2012); Ethical Markets Transforming Finance Series 2013

422 – Investing in Desert-Greening

“Investing in Desert Greening” — Discussion with Dennis Bushnell, chief

scientist, NASA Langley; Carl Hodges, founder, Seawater Foundation, and

Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

423 – “Making Ethical Investing the New Norm”

“Making Ethical Investing the New Norm” — Discussion with MARIANA BOZESAN, Founder & General Manager of AQAL Capital GmbH, and GARVIN JABUSCH, cofounder and chief investment officer of Green Alpha ® Advisors, and Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

424 – “Rating the Rating Agencies”

“Rating the Rating Agencies” — Discussion with Claudine Schneider, Congresswoman, US House of Representatives (R-RI), 1980-1990,Lawrence Bloom, FRICS, Co-Founder & Chairman, B.e Energy, and Hazel Henderson, president, Ethical Markets Media; Ethical Markets

Transforming Finance Series 2014

425 – “How Adam Smith and Charles Darwin Got Hijacked” – Discussion with Kim Ann

“How Adam Smith and Charles Darwin Got Hijacked” – Discussion with Kim Ann

Curtin, author, CEO, The Wall Street Coach, and Hazel Henderson, president,

Ethical Markets Media; Ethical Markets Transforming Finance Series 2014

426 – “Transforming Wall Street” – Discussion with Kim Ann Curtin, author, CEO,

“Transforming Wall Street” – Discussion with Kim Ann Curtin, author, CEO,

The Wall Street Coach, and Hazel Henderson, president, Ethical Markets

Media; Ethical Markets Transforming Finance Series 2014

785 – Reforming Capital Markets and Corporate Governance

In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, what reforms still are needed in capital markets. They review the challenges and progress over the past decades as ethical, green investing began to go mainstream which now in the USA alone comprises $6.57 trillion or 18% of total investments. Future expansion is expected as accounting reforms expose real risks such as water shortages and climate change excluded in traditional financial models

789 – Reforming Capital Markets and Corporate Governance

In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, what reforms still are needed in capital markets. They review the challenges and progress over the past decades as ethical, green investing began to go mainstream which now in the USA alone comprises $6.57 trillion or 18% of total investments. Future expansion is expected as accounting reforms expose real risks such as water shortages and climate change excluded in traditional financial models.

790 – The Future of Education

In this program, Hazel Henderson discusses with Dr. William Abare, President, Flagler College, how education is changing. They explore the growing challenges to education: costs rising faster than inflation; students bearing $1.2 trillion in loans while facing disruptive technological changes and job markets shifting globally. Traditional colleges are challenged by massive open online courses (MOOCs) such as Khan Academy, backed by Bill Gates, and other start-ups now funded by Silicon Valley capitalists, with millions of students learning free online. How can the benefits of campus-based education be extended to include more student and help counter growing inequality?

791 – The Future of Business Education

In this program, Hazel Henderson explores innovative courses with Dr. Allison Roberts, Chair of the Business Administration Department, Flagler College. They critique the values underlying much traditional business education which still teach with obsolete textbooks and assumptions that self-interest competition is “human nature”. Old courses still assume the impacts of business activities harming others and their environmental costs can be “externalized” from company balance sheets. Dr. Roberts, whose doctorate is in health and labor economics, has designed a more scientific curriculum, taking account of social and technological changes that have changed the global economy. Dr. Roberts teaches broader analyses and strategies for business success and new scorecards so that her students can prosper in the 21st century while contributing to more sustainable societies

792 – Reforming Business Education for Sustainable Economies

– In this program, Hazel Henderson discusses with Linda Crompton, MA, MBA, pioneering Canadian bank president and mutual fund innovator, how business courses need to catch up with changes in today’s finance and business. They review the urgent need to reform curricula at business schools in North America and Europe. Many still are teaching from obsolete textbooks with faulty assumptions that still permit companies, financiers and governments to “externalize” the social and environmental impacts from their balance sheets and pass on the costs to taxpayers, citizens and the environment.

720 – Asia’s Challenges to Western Economies

In this program, Hazel Henderson and Asian Markets Sustainability Analyst Matthew McGarvey, both China experts, review the new challenges China poses to Western economies as well as from other emerging economies in Asia. Western economists misunderstand the restructuring in China from exports toward domestic goals and shifting from polluting coal to wind, solar and the “circular economy” and their “Green GDP.” The new Asian Infrastructure Investment Bank (AIIG) led by China has attracted members like Britain and other European countries, as well as the IMF. Yet, the US Congress refused to join and is now out in the cold. The rush to new mega-trade deals in Asia and the need for new rules and metrics are explored.

794 – Transitioning Economies Towards New Values

In this program, Hazel Henderson and Asian Markets Sustainability Analyst Matthew McGarvey, who has lived in China, Vietnam and regularly visits Asia, discuss trends toward new values beyond Western GDP-measured economic growth. Asian economics’ models tend toward the Chinese view that “markets are good servants but bad masters.” Government rule-setting and oversight are favored and often authoritarian. Matt McGarvey recounts his personal journey from growing up in America’s heartland to learning Chinese and working in Beijing, and his experiences in Vietnam and other Asian countries.

793 – Artificial Intelligence: What Happens As Machines Take Over?

In this program, Hazel Henderson and NASA Chief Scientist Dennis Bushnell discuss the new alarms raised by Bill Gates, Google’s Eric Schmidt, Space-Ex and Tesla’s founder Elon Musk and physicist Stephen Hawking that intelligent machines like IBM’s Watson may soon outsmart humans. These computer pioneers believe this could pose existential danger to human civilization – because they may not share human values and may cause us great harm. Bushnell cites all the areas where computers are already smarter and more efficient than humans: in law, medicine, accounting and will be needed in NASA’s space program. Henderson worries about the societal impacts as ever more sectors of modern economies are digitized, now displacing white collar jobs beyond earlier manufacturing automation since the 1960s. While futurists envisioned “leisure societies,” shorter work weeks, guaranteed basic incomes and flowering of culture, art and human potentials – what we got was unemployment, stagnant wages and longer work hours.

788 – Robots Taking Over: What Will Humans Do?

In this program, Hazel Henderson and NASA Chief Scientist Dennis Bushnell explore the advance of automation as ever more sectors of industrial societies are digitized: from manufacturing to retailing, accounting, healthcare, education, legal services and even finance. Driverless vehicles will end jobs in trucking, taxis, which offer millions of entry-level opportunities. Fly-by-wire airplanes have caused the deskilling of pilots, some of whom have been confused when computerized navigation systems have failed – causing crashes. Can computerized systems be programmed with human values: empathy, compassion and ethics? Can a driverless car pass an ethical test of judgment: swerving to avoid hitting a group of people at the expense of colliding with a single person? Bushnell points out how much more efficient computers are at many tasks than humans. Henderson looks at the macro-effects: how can economies maintain aggregate demand to buy all the new productivity’s goods and services? How can people obtain purchasing power if not from jobs? They discuss alternatives emerging: worker-owned companies, cooperative enterprises and guaranteed basic incomes now enacted in Brazil, Mexico and proposed in Switzerland, Europe and the USA.

786 – Privacy in the New Media Age: Part I